Uniswap V3 Tutorial: Provide Liquidity & Earn Fees on Ethereum's Top DEX

Ever dreamt of passively earning crypto while contributing to the backbone of decentralized finance? Uniswap V3 offers a powerful opportunity to do just that – by becoming a liquidity provider. But navigating the complexities of concentrated liquidity can feel daunting. Don't worry, we're here to guide you!

Many individuals struggle with the perceived complexities of providing liquidity, especially in the advanced environment of Uniswap V3. Understanding impermanent loss, choosing the right price ranges, and managing active positions can feel overwhelming, turning potential earners away from this exciting opportunity.

This guide aims to demystify the process of providing liquidity on Uniswap V3, specifically focusing on the Ethereum network. We'll break down the core concepts, walk you through the practical steps, and equip you with the knowledge to make informed decisions, allowing you to confidently participate in this dynamic ecosystem and earn fees.

By the end of this guide, you'll understand the fundamentals of Uniswap V3, including concentrated liquidity, impermanent loss, and fee structures. You'll also learn how to deposit tokens, select appropriate price ranges, monitor your positions, and optimize your strategies to maximize your returns. Think of it as your complete guide to becoming a liquidity provider on Ethereum's leading decentralized exchange.

Understanding Concentrated Liquidity

My first foray into Uniswap V3 felt like stepping into a brand new world. I remember staring at the interface, utterly bewildered by the concept of "price ranges." I was so used to the simplicity of V2, where liquidity was spread evenly across the entire price curve. With V3, the idea that I could choose a specific price range to focus my liquidity felt both incredibly powerful and incredibly risky. I spent hours reading articles and watching videos, trying to wrap my head around how it all worked.

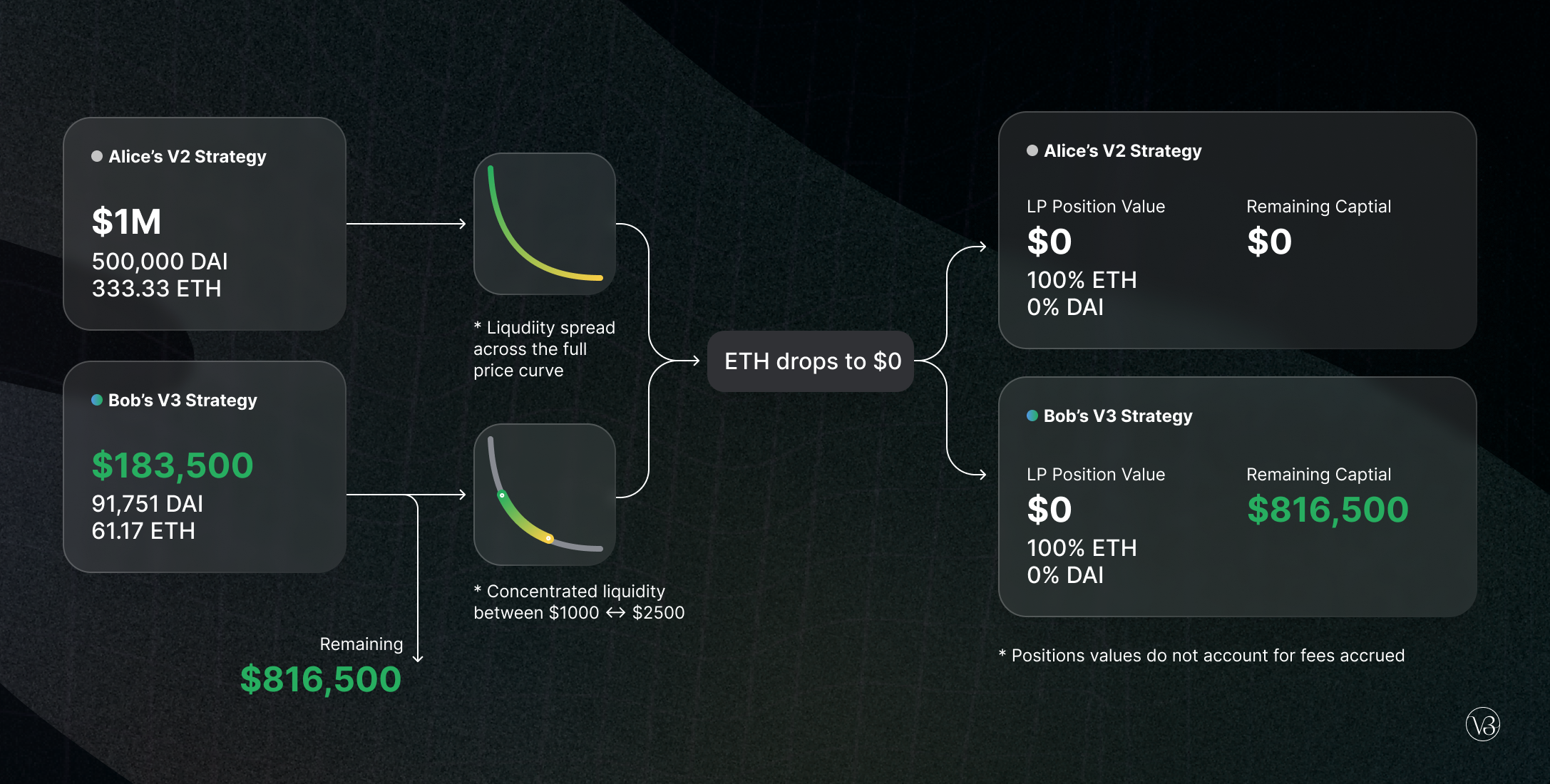

Concentrated liquidity is the heart of Uniswap V3's efficiency. Unlike previous versions where liquidity was distributed uniformly across all price points, V3 allows liquidity providers (LPs) to allocate their capital to specific price ranges. This focused allocation creates deeper liquidity within those ranges, leading to lower slippage and more efficient trades for users. For LPs, it means the potential to earn significantly higher fees with the same amount of capital, as their liquidity is actively being used for trades within their chosen range. However, this also introduces the concept of "out-of-range" liquidity, where if the price moves outside your specified range, your liquidity ceases to earn fees until the price returns. This requires active management and a good understanding of the trading pair's volatility. Understanding these nuances is crucial for success in Uniswap V3. Think of it like this: in V2, you were spreading butter thinly across a whole loaf of bread. In V3, you're piling it high on just your favorite slice!

What is Impermanent Loss?

Impermanent Loss (IL) is a term that strikes fear into the hearts of many liquidity providers. Simply put, it's the potential loss of value that can occur when you provide liquidity to a pool, compared to simply holding the tokens in your wallet. It happens because the pool's price changes relative to the prices when you deposited your tokens.

Let's say you deposit ETH and DAI into a pool. If the price of ETH increases significantly compared to DAI, traders will arbitrage the pool, buying ETH and selling DAI to bring the pool's price back in line with the market. This rebalancing process results in you having fewer ETH tokens and more DAI tokens than you initially deposited. If the price of ETH had stayed the same, you would have more ETH. The difference between the value of what you have now (fewer ETH, more DAI) and what you would have had if you just held your original ETH and DAI is impermanent loss. It's "impermanent" because the loss is only realized if you withdraw your liquidity while the price difference persists. If the prices revert to their original values, the loss disappears. However, it's crucial to understand that impermanent loss can offset the fees you earn from providing liquidity, so careful planning and risk management are essential. Providing liquidity can be more profitable than just holding, but not always, understanding IL is extremely important.

History and Myth of Uniswap V3

Uniswap's journey from a simple proof-of-concept to a De Fi powerhouse is a captivating story. The initial versions laid the foundation for decentralized trading, but V3 marked a significant leap forward. There's a certain mystique surrounding the project, fueled by its open-source nature and the rapid innovation within the De Fi space. Some even see it as a revolutionary force disrupting traditional finance.

One of the common myths is that Uniswap is entirely passive income. While providing liquidity can generate fees, it requires active management and an understanding of the risks involved. Another misconception is that all pools are equally profitable. In reality, the profitability of a pool depends on factors like trading volume, volatility, and the price range you choose. Then there is also a myth that you need to be a technical expert to participate in V3. While it does require some learning, tools and resources exist to help users of all experience levels. Uniswap v3's innovation of concentrated liquidity has made it more complex, but at the same time has offered greater returns for savvy users.

Hidden Secrets of Uniswap V3

One of the lesser-known aspects of Uniswap V3 is the importance of backtesting your strategies. Before committing significant capital, it's wise to analyze historical data to understand how a particular trading pair has performed in the past. This can help you identify optimal price ranges and refine your risk management approach.

Another hidden secret lies in the power of community tools. Numerous third-party platforms offer analytics dashboards, impermanent loss calculators, and automated rebalancing strategies. Leveraging these tools can significantly enhance your profitability and reduce the time you spend managing your positions. Also, understanding the gas costs associated with different actions is crucial. Opening and closing positions, claiming fees, and rebalancing can all incur gas fees, which can eat into your profits if you're not careful. Timing your transactions during periods of low network congestion can save you a significant amount of money. These hidden secrets can give you a competitive edge and help you maximize your returns on Uniswap V3.

Recommendations for Providing Liquidity on Uniswap V3

My top recommendation for anyone starting out with Uniswap V3 is to start small and experiment. Don't invest more than you can afford to lose, and focus on learning the ropes before scaling up your positions. Focus on stablecoin pairs initially, as these tend to be less volatile and easier to manage. Pairs like USDC/DAI or USDT/USDC can provide a relatively stable source of fees with lower risk of impermanent loss.

Also, consider using a portfolio tracking tool to monitor your positions and assess your overall profitability. These tools can help you identify underperforming pools and adjust your strategies accordingly. Finally, don't be afraid to ask for help. The De Fi community is incredibly supportive, and there are plenty of resources available online to answer your questions and guide you on your journey. Engaging with other liquidity providers and sharing your experiences can be invaluable. Remember, continuous learning and adaptation are key to success in the dynamic world of De Fi.

Choosing the Right Price Range

Selecting the appropriate price range is arguably the most crucial decision you'll make as a Uniswap V3 liquidity provider. This range dictates the price points at which your liquidity will be actively used for trading, and therefore, the amount of fees you'll earn. A narrower range concentrates your liquidity, potentially leading to higher fees but also increasing the risk of going "out-of-range." A wider range provides more coverage but dilutes your liquidity, resulting in lower fees.

Several factors influence the ideal price range, including the volatility of the trading pair, your risk tolerance, and your investment strategy. If you're trading a stablecoin pair with low volatility, a narrow range can be highly effective. However, if you're trading a more volatile asset, a wider range may be necessary to ensure your liquidity remains active. Analyzing historical price data and understanding the trading patterns of the pair can provide valuable insights. Consider using technical analysis tools to identify potential support and resistance levels, which can help you define your price range. Ultimately, the best approach is to experiment with different ranges and monitor your results to find what works best for you. Remember that you can always adjust your range as market conditions change.

Tips for Managing Impermanent Loss

Minimizing impermanent loss is a key priority for any Uniswap V3 liquidity provider. While you can't eliminate it entirely, several strategies can help you mitigate its impact. One approach is to choose pools with low volatility or pools that are correlated with your overall portfolio. For example, if you're bullish on ETH, providing liquidity to an ETH-based pool can help offset any impermanent loss with potential gains from ETH price appreciation.

Another tip is to actively monitor your positions and rebalance your liquidity as needed. If the price moves significantly outside your chosen range, consider adjusting your range to bring your liquidity back into play. Using limit orders to rebalance your positions can help you minimize slippage and gas costs. You can also consider using automated rebalancing strategies offered by third-party platforms. These strategies automatically adjust your price range based on market conditions, helping you maximize your fee earnings and minimize impermanent loss. Finally, remember that the fees you earn from providing liquidity can help offset any impermanent loss. By carefully selecting your pools, managing your price ranges, and actively monitoring your positions, you can significantly reduce your risk and maximize your returns.

Understanding Gas Fees

Gas fees are the transaction fees required to execute operations on the Ethereum blockchain. These fees fluctuate based on network congestion and the complexity of the transaction. As a Uniswap V3 liquidity provider, you'll encounter gas fees when depositing and withdrawing liquidity, adjusting your price range, and claiming fees. Understanding how gas fees work and how to optimize your transactions is crucial for maximizing your profitability.

One strategy for minimizing gas fees is to time your transactions during periods of low network congestion. You can use gas trackers to monitor current gas prices and identify optimal times to execute your transactions. Another tip is to use batching techniques, where possible, to combine multiple operations into a single transaction. This can significantly reduce the overall gas cost. For example, you can claim your fees and rebalance your position in a single transaction. You can also consider using layer-2 scaling solutions like Optimism or Arbitrum, which offer significantly lower gas fees than the Ethereum mainnet. While these solutions may have some limitations, they can be a cost-effective way to participate in Uniswap V3.

Fun Facts About Uniswap V3

Did you know that Uniswap V3 was initially launched on the Ethereum mainnet in May 2021? It quickly gained traction and has since become one of the most popular decentralized exchanges in the De Fi space. Another fun fact is that Uniswap V3 is completely open-source, meaning anyone can view, modify, and contribute to the codebase. This has fostered a vibrant community of developers and researchers who are constantly pushing the boundaries of decentralized finance.

Also, Uniswap V3 has processed billions of dollars in trading volume, making it a critical piece of infrastructure for the De Fi ecosystem. The concentrated liquidity feature of V3 has significantly improved capital efficiency, allowing traders to execute larger trades with less slippage. The platform is governed by a decentralized autonomous organization (DAO), which allows UNI token holders to vote on important decisions related to the protocol's development and governance. The future of Uniswap is in the hands of its users.

How to Provide Liquidity on Uniswap V3

Providing liquidity on Uniswap V3 involves a few simple steps. First, you'll need to connect your wallet to the Uniswap interface. Make sure you have enough ETH to cover the gas fees associated with the transaction. Next, select the trading pair you want to provide liquidity for and choose your desired price range. Consider the volatility of the pair and your risk tolerance when selecting your range.

Then, deposit the required amount of each token into the pool. You'll need to approve the Uniswap contract to spend your tokens before you can deposit them. Once your deposit is confirmed, you'll receive an NFT representing your liquidity position. You can use this NFT to manage your position, claim fees, and withdraw your liquidity. Remember to actively monitor your position and adjust your price range as needed to maximize your fee earnings and minimize impermanent loss. Providing liquidity can be a great way to earn passive income in the De Fi space.

What if Impermanent Loss Outweighs Fee Earnings?

It's a valid concern: what happens if impermanent loss eats up all the fees you've earned, leaving you with a net loss? This is a risk inherent in providing liquidity, especially in volatile markets. If you find yourself in this situation, it's essential to reassess your strategy. One option is to adjust your price range to better reflect the current market conditions.

Another approach is to switch to a different pool with lower volatility or higher trading volume. You can also consider withdrawing your liquidity altogether and reinvesting it elsewhere. Before making any decisions, carefully analyze your position and consider the potential impact of each action. Use impermanent loss calculators to estimate your potential losses and weigh them against the potential fee earnings. Remember that the goal is to maximize your overall returns, even if it means taking a small loss on a particular position. Don't be afraid to cut your losses and move on to greener pastures.

Listicle of Uniswap V3 Tips and Tricks

Here's a quick rundown of essential Uniswap V3 tips and tricks to keep in mind:

- Start small and experiment with different strategies.

- Choose pools with low volatility to minimize impermanent loss.

- Actively monitor your positions and adjust your price range as needed.

- Use limit orders to rebalance your positions and minimize slippage.

- Consider using automated rebalancing strategies.

- Time your transactions during periods of low network congestion.

- Use gas trackers to monitor current gas prices.

- Consider using layer-2 scaling solutions for lower gas fees.

- Analyze historical price data to inform your trading decisions.

- Use portfolio tracking tools to monitor your overall profitability.

By following these tips and tricks, you can significantly improve your chances of success as a Uniswap V3 liquidity provider.

Question and Answer About Uniswap V3 Tutorial

Q: What is concentrated liquidity?

A: Concentrated liquidity allows LPs to allocate capital to specific price ranges, increasing capital efficiency.

Q: What is impermanent loss?

A: Impermanent loss is the potential loss of value compared to simply holding the tokens, caused by price divergence.

Q: How do I choose the right price range?

A: Consider volatility, risk tolerance, and analyze historical price data to select an appropriate range.

Q: How can I minimize gas fees?

A: Time transactions during low congestion, use batching, or explore layer-2 solutions.

Conclusion of Uniswap V3 Tutorial

Mastering Uniswap V3 takes time and effort, but the potential rewards are substantial. By understanding the core concepts, managing your risks, and continuously learning, you can unlock the power of concentrated liquidity and earn fees on Ethereum's leading DEX. So, dive in, experiment, and become a successful liquidity provider!

Post a Comment