Top 10 Crypto Research Tools 2025: From CoinGecko to Messari (Professional Guide)

Imagine navigating the complex world of cryptocurrency armed with the perfect tools, like a seasoned explorer charting unknown territories. Investing in crypto assets requires more than just intuition; it demands thorough research and a deep understanding of market trends, project fundamentals, and risk factors. Choosing the right resources can be the difference between making informed decisions and falling victim to market volatility.

For crypto enthusiasts, sifting through an overload of information, discerning credible data from noise, and keeping pace with rapid industry changes can feel like a daunting task. Locating reliable metrics, comprehensive analysis, and actionable insights within the vast digital landscape represents a considerable challenge, even for experienced investors. This struggle often leads to missed opportunities, uninformed investment decisions, and increased susceptibility to scams and market manipulation.

This professional guide aims to equip you with the top 10 crypto research tools you'll need in 2025 to make smarter, data-driven investment decisions. From established platforms like Coin Gecko and Messari to emerging analytics dashboards, we'll explore the resources that provide critical data, in-depth analysis, and valuable insights into the ever-evolving crypto market. This guide will help you streamline your research process, identify promising projects, and navigate the complexities of the digital asset space with confidence.

In this comprehensive guide, we'll dive into the top 10 crypto research tools projected to be essential in 2025, covering established platforms like Coin Gecko and Messari, as well as up-and-coming analytical resources. We will explore the features, benefits, and use cases of each tool, providing you with the knowledge needed to make informed investment decisions in the dynamic cryptocurrency market. The aim is to streamline your research, identify potential opportunities, and navigate the crypto landscape with greater confidence and expertise. Key topics will include on-chain analytics, market sentiment analysis, fundamental project evaluations, and risk assessment tools.

Diving Deep into Coin Gecko

Coin Gecko, a cornerstone in the crypto research space, has been my go-to platform since I first dipped my toes into the world of digital assets. I remember feeling completely overwhelmed by the sheer volume of cryptocurrencies and exchanges. Coin Gecko provided a much-needed sense of order, presenting key data points like price, volume, market capitalization, and circulating supply in a clear and accessible format. This allows for quick comparisons and helps paint a broad picture of market trends.

Beyond the basic metrics, Coin Gecko excels in tracking developer activity, community engagement, and liquidity scores. These more nuanced data points offer valuable insights into the health and potential of a project. For instance, a project with consistent developer activity on Git Hub suggests that the team is actively working on improvements and updates, which is generally a positive sign. Similarly, a strong and active community indicates a loyal following and a higher likelihood of long-term adoption.

One of my favorite features of Coin Gecko is its comprehensive token information pages. Each token page provides a wealth of information, including the project's whitepaper, team members, social media links, and historical price data. This allows you to conduct thorough due diligence and gain a deep understanding of the project's fundamentals before investing. In 2025, Coin Gecko is expected to continue its dominance as a leading crypto data aggregator, possibly adding more advanced analytical tools and integrating with other research platforms to offer a more holistic research experience.

Unveiling the Power of Messari

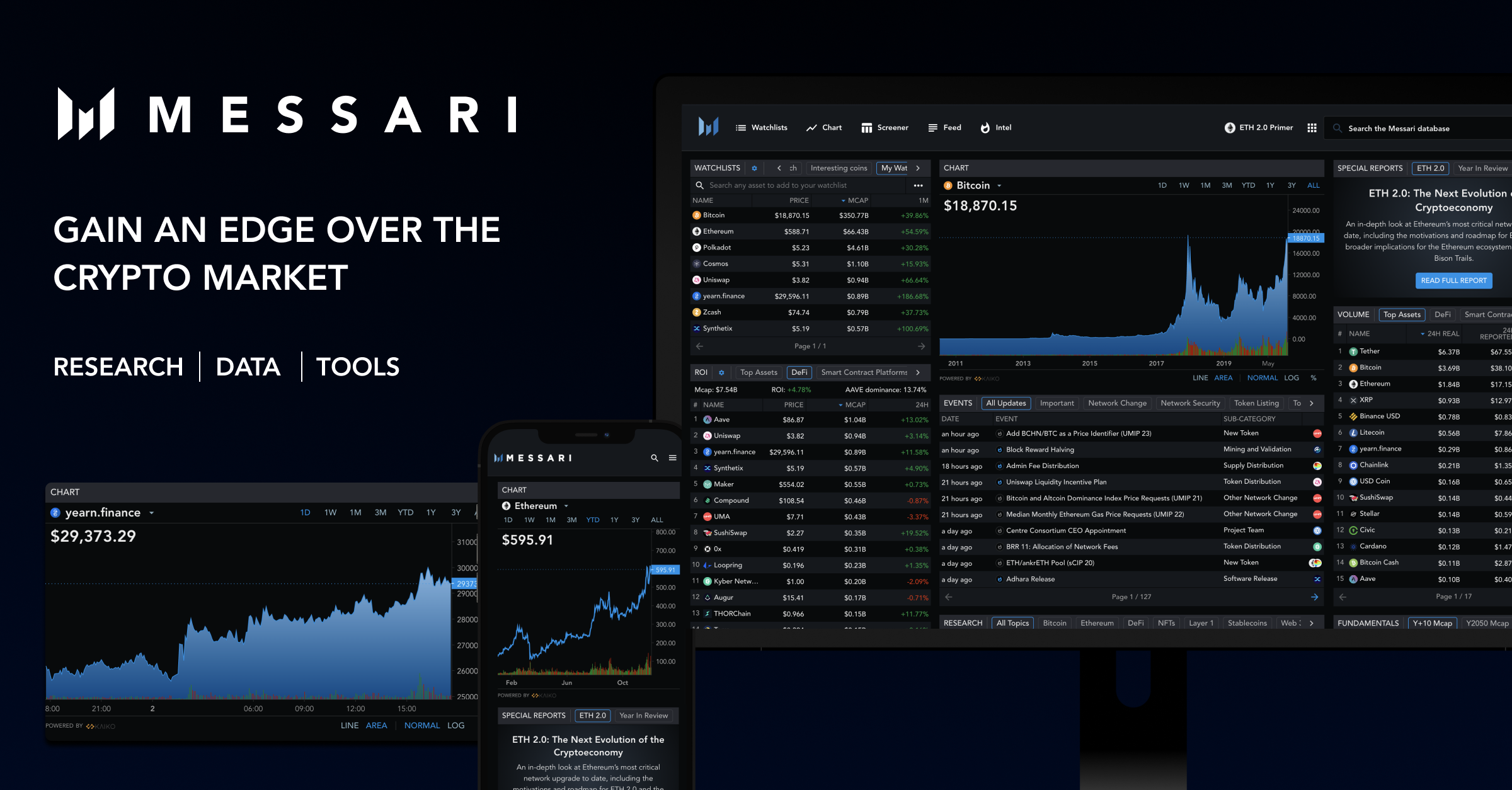

Messari stands out as a premium crypto research platform focused on providing institutional-grade data, research, and tools. It's designed to equip investors with the insights they need to make informed decisions in the digital asset space. Unlike some free platforms that rely on aggregated data, Messari emphasizes data integrity and transparency. Their team of analysts conducts in-depth research on various crypto assets, producing detailed reports and analyses that cover everything from tokenomics to governance structures.

The platform's strength lies in its ability to provide a 360-degree view of a crypto asset, integrating data from multiple sources and presenting it in a concise and actionable manner. One of the key features of Messari is its asset profiles, which provide a comprehensive overview of each crypto asset, including its purpose, technology, team, and market performance. These profiles are constantly updated with the latest information, ensuring that investors have access to the most accurate and relevant data.

In 2025, Messari is expected to become even more crucial for institutional investors and sophisticated retail traders. As the crypto market matures, the demand for high-quality research and data will only increase. Messari's focus on transparency and data integrity makes it a valuable resource for those seeking to make informed investment decisions and avoid the pitfalls of the market.

The History and Myth of Crypto Research Tools

The history of crypto research tools is intertwined with the evolution of the cryptocurrency market itself. In the early days, research was rudimentary, relying heavily on forums, blogs, and word-of-mouth. Data was scattered, unreliable, and often influenced by biased opinions. The lack of credible information made it difficult for investors to make informed decisions and contributed to the volatility and risk associated with the nascent market.

As the market matured, so did the need for more sophisticated research tools. Platforms like Coin Market Cap and Coin Gecko emerged, providing aggregated data on prices, market capitalization, and trading volume. These platforms brought much-needed structure and transparency to the market, allowing investors to track the performance of different cryptocurrencies and identify emerging trends.

However, even with these advancements, challenges remained. Data manipulation, fake trading volume, and biased information were still prevalent. This led to the development of more advanced research tools like Messari, which focused on data integrity and in-depth analysis. These platforms aimed to provide investors with a more comprehensive and reliable view of the crypto market. The "myth" surrounding crypto research tools is that they can guarantee investment success. While these tools can provide valuable insights and help investors make informed decisions, they cannot eliminate risk entirely. The crypto market is inherently volatile and unpredictable, and even the most sophisticated research tools cannot predict the future with certainty. In 2025, expect even more advanced tools that leverage AI and machine learning to filter out noise and identify hidden patterns, but remember that responsible investing always requires critical thinking.

Uncovering the Hidden Secrets with On-Chain Analytics

On-chain analytics represent a powerful approach to understanding cryptocurrency market dynamics by examining data directly from blockchain networks. This allows you to see transactions, wallet balances, smart contract interactions, and other crucial information that can't be easily obtained through traditional market analysis. Think of it as peering behind the curtain to observe the inner workings of the crypto ecosystem.

One of the key benefits of on-chain analytics is the ability to track whale activity. Large holders of cryptocurrencies, often referred to as "whales," can have a significant impact on market prices. By monitoring their transactions, you can gain insights into their sentiment and potential future actions. For example, a large outflow of Bitcoin from exchanges to cold storage wallets could indicate a bullish sentiment and a belief that prices will rise in the future.

Platforms like Glassnode and Nansen are at the forefront of on-chain analytics, offering a range of tools and metrics for tracking network activity, identifying market trends, and assessing the health of individual projects. In 2025, on-chain analytics are projected to become even more sophisticated and integrated into mainstream investment strategies. Expect to see more advanced tools that can analyze complex smart contract interactions, identify potential security vulnerabilities, and provide more granular insights into user behavior. Understanding on-chain data will be essential for navigating the increasingly complex crypto landscape.

Recommendations for Crypto Research Tools in 2025

When selecting crypto research tools in 2025, it's essential to consider your individual investment goals, risk tolerance, and level of technical expertise. There's no one-size-fits-all solution, and the best approach is to combine multiple tools to gain a comprehensive view of the market. For beginners, platforms like Coin Gecko and Coin Market Cap provide a solid foundation for understanding basic market data and tracking the performance of different cryptocurrencies.

For more experienced investors who want to delve deeper into project fundamentals, Messari offers institutional-grade research and data. Their asset profiles, research reports, and governance tools can help you assess the long-term potential of different crypto assets. If you're interested in understanding market dynamics and identifying potential trading opportunities, on-chain analytics platforms like Glassnode and Nansen can provide valuable insights into network activity and user behavior.

In addition to these established platforms, it's also worth exploring emerging research tools that leverage AI and machine learning to analyze market data and identify hidden patterns. These tools can help you stay ahead of the curve and discover new opportunities that others might miss. However, it's important to approach these tools with caution and always conduct your own due diligence before making any investment decisions. In 2025, the crypto research landscape is expected to be even more diverse and competitive, with a wider range of tools and platforms catering to different needs and preferences.

Understanding Market Sentiment Analysis

Market sentiment analysis in the crypto space involves gauging the overall attitude and emotions of investors towards a particular cryptocurrency or the market as a whole. This is crucial because sentiment can significantly influence price movements, often driven by fear, uncertainty, and doubt (FUD) or by optimism and excitement. Traditional methods of sentiment analysis often involve tracking social media trends, news articles, and forum discussions to identify the general mood surrounding a crypto asset.

Platforms like Lunar Crush and The TIE specialize in crypto sentiment analysis, using advanced algorithms to aggregate and analyze data from various sources. They provide metrics such as sentiment scores, social volume, and influencer activity, which can help you understand whether the market is generally bullish or bearish. For example, a sudden spike in negative sentiment surrounding a particular cryptocurrency could indicate a potential sell-off, while a sustained period of positive sentiment could suggest a potential rally.

In 2025, market sentiment analysis is expected to become even more sophisticated, incorporating more diverse data sources and leveraging AI to identify subtle shifts in investor attitudes. Expect to see tools that can analyze the emotional tone of social media posts, identify fake news and misinformation, and predict the impact of sentiment on price movements with greater accuracy. Understanding market sentiment is essential for making informed trading decisions and managing risk in the volatile crypto market.

Tips and Tricks for Effective Crypto Research

Effective crypto research requires a combination of technical skills, analytical thinking, and a healthy dose of skepticism. It's important to approach every project with a critical eye and avoid being swayed by hype or biased information. Here are some tips and tricks to help you conduct more effective crypto research:

First, always start with the whitepaper. The whitepaper is the project's official document that outlines its goals, technology, and roadmap. Reading the whitepaper carefully will help you understand the project's fundamentals and assess its potential. Second, research the team behind the project. Who are the founders and key members? What are their backgrounds and experience? A strong and experienced team is more likely to execute on their vision and deliver a successful product.

Third, analyze the tokenomics of the project. How is the token distributed? What is the total supply? Are there any vesting schedules or lock-up periods? Understanding the tokenomics will help you assess the potential for price appreciation and identify any potential risks. Fourth, evaluate the project's community. Is the community active and engaged? Are there a lot of discussions and questions? A strong community is a sign of a healthy project and a higher likelihood of long-term adoption. In 2025, expect to see more sophisticated research tools that automate some of these tasks and provide more comprehensive analysis. However, it's always important to remember that research is just one part of the investment process and that you should never invest more than you can afford to lose.

Assessing Project Fundamentals

Assessing project fundamentals is a crucial step in crypto research. It involves evaluating the underlying technology, business model, and potential of a cryptocurrency or blockchain project. This goes beyond just looking at price charts and market capitalization; it requires a deeper understanding of the project's purpose, its competitive landscape, and its ability to solve a real-world problem.

One of the key aspects of assessing project fundamentals is to analyze the technology behind the project. Is the technology innovative and unique? Does it offer any advantages over existing solutions? Is the technology scalable and secure? Understanding the technology will help you assess the project's long-term viability and potential for success. Another important factor is to evaluate the project's business model. How does the project generate revenue? Is the business model sustainable and scalable? A solid business model is essential for the project to thrive in the long run.

In addition, it's important to analyze the project's competitive landscape. Who are the project's main competitors? What are their strengths and weaknesses? How does the project differentiate itself from its competitors? Understanding the competitive landscape will help you assess the project's chances of success. Finally, it's important to consider the project's potential to solve a real-world problem. Does the project address a significant need or pain point? Is there a large market for the project's solution? In 2025, expect to see more sophisticated tools and frameworks for assessing project fundamentals, allowing investors to make more informed decisions.

Fun Facts About Crypto Research Tools

Did you know that the first crypto data aggregator, Coin Market Cap, was founded in 2013 by Brandon Chez from his apartment? This seemingly simple website became a cornerstone of the crypto industry, providing crucial data and transparency. Before Coin Market Cap, finding reliable information about cryptocurrencies was a fragmented and time-consuming process. It's amazing how one person's initiative transformed the way investors access and analyze crypto data.

Another fun fact is that many crypto research tools use web scraping techniques to gather data from various sources, including exchanges, social media platforms, and news websites. These techniques involve automatically extracting information from websites and organizing it into a structured format. While web scraping can be a powerful tool for gathering data, it also raises ethical and legal concerns, especially when it comes to respecting website terms of service and copyright laws.

In the early days of crypto, research was often conducted in online forums and chat rooms, where investors shared information and opinions. While these communities can still be valuable resources, it's important to be aware of the potential for bias and misinformation. Always do your own research and verify information from multiple sources before making any investment decisions. In 2025, expect to see even more innovative and creative approaches to crypto research, as the industry continues to evolve and adapt to new challenges and opportunities.

How to Choose the Right Crypto Research Tools for You

Selecting the right crypto research tools depends heavily on your individual needs, investment style, and technical expertise. A beginner, for example, might find comprehensive data aggregators like Coin Gecko and Coin Market Cap ideal for grasping market basics. These platforms present easily digestible data on pricing, market capitalization, and trading volumes. They provide a broad overview, helping newcomers navigate the vast crypto landscape without feeling overwhelmed.

Experienced investors, on the other hand, might crave in-depth analysis and institutional-grade data. For them, platforms like Messari become invaluable. Messari offers detailed reports, analyses on tokenomics, and governance structures, empowering informed decisions beyond surface-level metrics. Active traders looking to capitalize on short-term price movements might benefit from tools that track market sentiment and on-chain analytics, like Lunar Crush and Glassnode. These platforms offer insights into investor behavior, whale activity, and network health, allowing traders to anticipate potential market shifts.

Remember, there's no one-size-fits-all solution. The ideal approach involves combining various tools, pulling insights from different sources to form a holistic view. In 2025, with the continued evolution of research tools, expect more customization options and AI-powered recommendations to guide you toward the platforms best suited for your unique investment goals.

What If Crypto Research Tools Didn't Exist?

Imagine a world where crypto research tools vanished overnight. The impact on the cryptocurrency market would be significant and far-reaching. Without access to reliable data, accurate information, and in-depth analysis, investors would be forced to make decisions based on gut feelings, rumors, and speculation. The market would become even more volatile and unpredictable, with increased risk of scams, manipulation, and uninformed investment decisions.

Newcomers to the crypto space would face an even steeper learning curve, struggling to navigate the complexities of the market and differentiate between legitimate projects and fraudulent schemes. Institutional investors, who rely heavily on data-driven insights, would be hesitant to enter the market, further limiting its growth and adoption. The lack of transparency and accountability would undermine trust in the crypto ecosystem, hindering its potential to revolutionize finance and other industries.

In such a scenario, the crypto market would likely revert to its early days, characterized by fragmented information, unreliable data, and a high degree of uncertainty. The absence of crypto research tools would not only make it more difficult to invest in cryptocurrencies but also stifle innovation and development in the blockchain space. In 2025, it's hard to imagine a world without robust crypto research tools, as they have become an integral part of the market infrastructure.

Top 10 Crypto Research Tools 2025: A Listicle

Navigating the crypto space in 2025 requires a robust research arsenal. Here’s a curated listicle of the top 10 tools essential for staying ahead:

- Coin Gecko: For comprehensive data aggregation and market overview. It's your go-to for quick stats and general market trends.

- Messari: Delivers institutional-grade research, deep dives into projects, and transparent data. Ideal for serious investors.

- Glassnode: Excels in on-chain analytics, revealing insights into network activity and user behavior. Essential for understanding market dynamics.

- Lunar Crush: Aggregates sentiment analysis from across the web, helping gauge market mood and potential trend shifts.

- The TIE: Another powerful sentiment analysis platform, providing unique metrics and data on crypto conversations.

- Nansen: A leader in on-chain analytics, particularly useful for tracking smart money and whale activity.

- Santiment: Offers a suite of on-chain, social, and fundamental analysis tools, providing a holistic view of crypto projects.

- Coin Market Cap: A long-standing data aggregator, offering price charts, market cap rankings, and exchange information.

- Token Terminal: Focuses on financial metrics for crypto protocols, like revenue, transaction fees, and other key indicators.

- De Fi Pulse: Dedicated to decentralized finance (De Fi), tracking total value locked (TVL) and performance of De Fi projects.

In 2025, mastering these tools will be crucial for anyone looking to make informed decisions and thrive in the competitive crypto landscape. Remember to combine these resources and always conduct your own thorough research.

Question and Answer about Top 10 Crypto Research Tools 2025

Here's a quick Q&A to address common questions about crypto research tools:

Q: Are free crypto research tools reliable?

A: Free tools like Coin Gecko and Coin Market Cap provide valuable data but may lack the depth and accuracy of premium platforms like Messari. Use them as a starting point, but cross-reference information with other sources.

Q: Can crypto research tools guarantee investment success?

A: No, crypto research tools can help you make informed decisions, but they cannot eliminate risk. The crypto market is inherently volatile, and past performance is not indicative of future results.

Q: Which crypto research tool is best for beginners?

A: Coin Gecko is a great starting point for beginners due to its user-friendly interface and comprehensive data coverage. It provides a solid foundation for understanding basic market concepts.

Q: How often should I update my crypto research strategy?

A: The crypto market is constantly evolving, so it's important to update your research strategy regularly. Stay informed about new tools, platforms, and market trends to maintain a competitive edge.

Conclusion of Top 10 Crypto Research Tools 2025

In the ever-evolving landscape of cryptocurrency, staying informed is paramount. As we look towards 2025, the top 10 crypto research tools discussed in this guide – from established platforms like Coin Gecko and Messari to specialized analytics dashboards – will be indispensable for navigating the market's complexities. By mastering these tools, investors can gain a competitive edge, identify promising opportunities, and make data-driven decisions with greater confidence. Remember, effective crypto research requires a combination of technical skills, analytical thinking, and a healthy dose of skepticism. Embrace these resources, stay curious, and embark on your crypto journey with a well-equipped toolkit.

Post a Comment