THORChain Tutorial: Cross-Chain Swaps Without Wrapped Tokens or Bridges

Imagine a world where you can seamlessly trade Bitcoin for Ethereum, or Litecoin for Binance Coin, without the hassle of wrapped tokens or risky bridges. Sounds like a crypto dream, right? Well, it's closer to reality than you might think, thanks to THORChain.

Let's face it, navigating the world of decentralized finance (De Fi) can feel like traversing a minefield. You're constantly bombarded with complex processes, the need to wrap tokens, and the lingering fear of bridge exploits. It's enough to make anyone's head spin. Security concerns and complexities often keep people away from cross-chain swaps.

This tutorial aims to guide you through the revolutionary world of THORChain, a decentralized protocol that enables cross-chain swaps without the need for wrapped tokens or bridges. We'll explore how it works, its benefits, and how you can get involved in this exciting new frontier of De Fi. We will show you the ropes of THORChain's innovative approach to cross-chain swaps.

In this article, we will dive deep into THORChain, exploring its core functionality, how it facilitates native asset swaps, and its unique approach to security. We'll cover its architecture, the role of node operators, and how liquidity providers contribute to the network's stability. We'll also touch on the potential risks and rewards of participating in the THORChain ecosystem. Buckle up, because we're about to embark on a journey into the heart of cross-chain De Fi, exploring the innovative world of native asset swaps on THORChain.

Understanding Native Cross-Chain Swaps

The concept of native cross-chain swaps is what sets THORChain apart. I remember the first time I heard about it; I was skeptical. Every other platform I had used required wrapping tokens, which always felt like an unnecessary step and introduced extra layers of risk. The idea of trading Bitcoin directly for Ethereum without any intermediary felt like a game-changer. My early experience with bridging was scary. I sent a small amount of ETH to a bridge and it took a long time to arrive. I was worried that I had lost it.

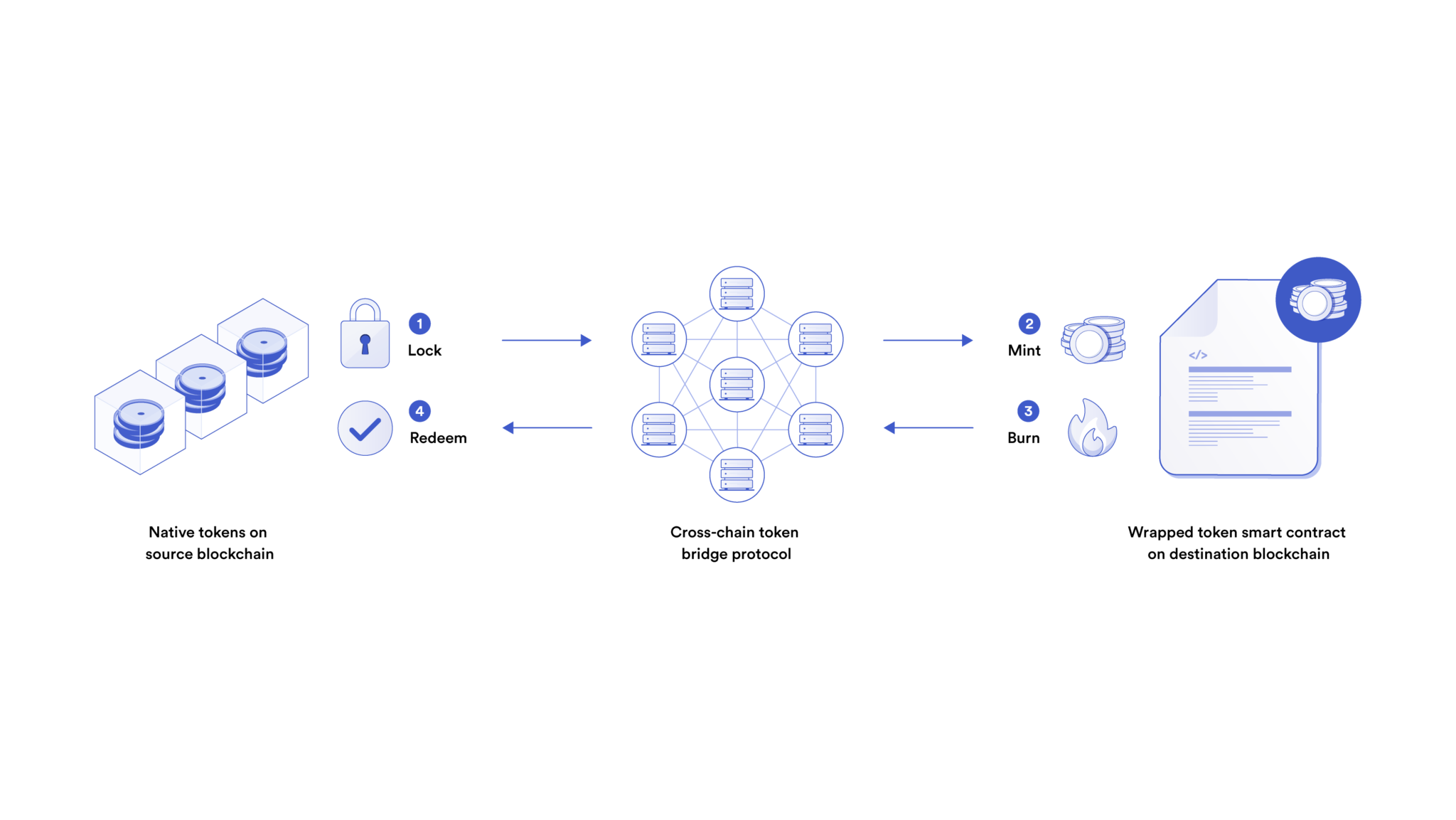

The beauty of THORChain is that it allows you to swap assets directly on their native blockchains. So, instead of converting your Bitcoin into a wrapped version like w BTC, you can trade your native BTC directly for native ETH. This is achieved through a network of independent nodes that maintain liquidity pools for various assets. When you initiate a swap, the network automatically routes your transaction through these pools, ensuring a seamless and trustless exchange. This eliminates the need for trusted custodians or intermediaries, significantly reducing the risk of hacks or theft. In essence, THORChain acts as a decentralized exchange that connects different blockchains, allowing you to trade your crypto assets without ever having to leave the security of their native networks.

What is THORChain?

THORChain is a decentralized, cross-chain liquidity protocol that allows users to swap digital assets across different blockchains in a permissionless and non-custodial manner. It's designed to be chain-agnostic, meaning it can support a wide range of blockchains, including Bitcoin, Ethereum, Litecoin, and Binance Chain. This interoperability is crucial for creating a more connected and efficient De Fi ecosystem.

At its core, THORChain is a network of independent nodes that operate a continuous liquidity pool (CLP) system. These nodes are responsible for validating transactions, maintaining the network's security, and ensuring the smooth operation of the swaps. The CLP system allows users to provide liquidity to the network by depositing assets into the pools and earning rewards in the form of swap fees and RUNE emissions. The RUNE token is the native token of the THORChain network and plays a vital role in its security and governance. It is used to incentivize node operators, reward liquidity providers, and participate in the network's decision-making processes. By staking RUNE, users can earn a portion of the network's revenue and have a say in its future development.

History and Myth of THORChain

The name "THORChain" itself is steeped in Norse mythology, drawing inspiration from the legendary god of thunder, Thor. Just as Thor's hammer, Mjolnir, could traverse realms and connect disparate worlds, THORChain aims to bridge the gap between different blockchains, fostering a more unified and interconnected crypto ecosystem. The project was initially conceived during a Binance Chain hackathon in 2018, where a team of developers envisioned a decentralized protocol that could enable cross-chain swaps without the need for intermediaries.

The early days of THORChain were marked by intense development and experimentation. The team faced numerous technical challenges in building a secure and efficient cross-chain protocol. However, they persevered, driven by the belief that a truly decentralized and interoperable De Fi ecosystem was essential for the future of finance. In 2021, THORChain launched its mainnet, marking a significant milestone in its journey. Since then, the network has continued to grow and evolve, attracting a vibrant community of users, developers, and node operators. Today, THORChain stands as a testament to the power of open-source collaboration and the unwavering pursuit of decentralized innovation. Its ability to facilitate native asset swaps without wrapped tokens or bridges has made it a groundbreaking force in the De Fi landscape.

Hidden Secrets of THORChain

One of the most intriguing aspects of THORChain is its use of a "continuous liquidity pool" (CLP) model. This innovative approach allows the network to maintain deep liquidity for a variety of assets, enabling seamless swaps even for large transaction sizes. The secret sauce lies in the interplay between the RUNE token and the other assets in the pools. RUNE acts as the settlement asset, meaning that all swaps are ultimately routed through RUNE. This creates a constant demand for RUNE, which helps to stabilize its price and incentivize liquidity providers to contribute to the network.

Another hidden secret of THORChain is its use of a sophisticated economic model to ensure its long-term sustainability. The network employs a system of incentives and penalties to encourage node operators to act honestly and maintain the network's security. Nodes that attempt to cheat the system or fail to meet their obligations are penalized, while those that act in good faith are rewarded with RUNE tokens. This creates a self-regulating ecosystem that is resistant to manipulation and ensures the network's continued operation. Furthermore, THORChain's commitment to transparency and open-source development allows anyone to inspect the code and verify its integrity. This fosters trust and accountability, which are essential for the success of any decentralized protocol.

Recommendations of THORChain

If you're looking for a way to participate in the De Fi revolution without the risks associated with wrapped tokens and bridges, THORChain is definitely worth exploring. Its unique approach to cross-chain swaps offers a secure and efficient way to trade your digital assets across different blockchains. However, it's important to approach THORChain with a clear understanding of its risks and rewards. Before you start swapping or providing liquidity, take the time to research the project thoroughly and understand its underlying mechanics.

Consider starting with small amounts to get a feel for the platform and its functionalities. It's also a good idea to diversify your portfolio and not put all your eggs in one basket. Keep in mind that THORChain is still a relatively new project, and like any emerging technology, it carries certain risks. There is a risk of impermanent loss when providing liquidity to the pools. Impermanent loss occurs when the price of the assets in the pool diverge, resulting in a temporary loss of value. However, the rewards earned from swap fees and RUNE emissions can often offset this loss. By carefully managing your risks and rewards, you can maximize your chances of success in the THORChain ecosystem.

Risks of Using THORChain

While THORChain offers a compelling solution for cross-chain swaps, it's important to be aware of the potential risks involved. One of the most significant risks is impermanent loss, which can occur when providing liquidity to the pools. Impermanent loss happens when the price of the assets in the pool diverge, resulting in a temporary loss of value. This is because the pool is designed to maintain a constant ratio between the assets, and when the price of one asset increases relative to the other, the pool will automatically sell off some of the higher-priced asset and buy more of the lower-priced asset to rebalance the ratio.

Another risk to consider is the possibility of smart contract vulnerabilities. While THORChain's smart contracts have been audited by reputable firms, there is always a chance that unforeseen bugs or vulnerabilities could be exploited by malicious actors. It's also important to be aware of the risks associated with node operators. THORChain relies on a network of independent nodes to validate transactions and maintain the network's security. If a significant number of nodes were to become compromised or collude to attack the network, it could potentially lead to a loss of funds for users. However, THORChain has implemented various mechanisms to mitigate these risks, including economic incentives for honest behavior and penalties for malicious activity. Ultimately, the risks associated with using THORChain are similar to those associated with any other decentralized protocol. It's important to do your own research and understand the risks involved before participating in the ecosystem.

Tips for Using THORChain

Before diving into THORChain, it's crucial to understand the core concepts and functionalities. Take some time to explore the THORChain website, read the documentation, and familiarize yourself with the network's architecture and economic model. A solid understanding of the underlying principles will help you make informed decisions and navigate the platform more effectively.

When providing liquidity to the pools, it's important to choose assets that you are comfortable holding for the long term. Keep in mind that impermanent loss can occur when the price of the assets diverge, so it's best to select assets that you believe will appreciate in value over time. Also, consider diversifying your liquidity positions across different pools to reduce your overall risk exposure. Before making any swaps, it's always a good idea to compare the prices on THORChain with those on other exchanges to ensure that you are getting the best possible deal. You can use various tools and aggregators to compare prices across different platforms. Finally, stay informed about the latest developments and updates in the THORChain ecosystem. Follow the project's official channels, such as their website, Twitter, and Telegram, to stay up-to-date on new features, security updates, and community events.

Understanding Impermanent Loss

Impermanent loss is a key concept to grasp when participating in liquidity pools, not just on THORChain, but across various De Fi platforms. It essentially arises when the price ratio of the assets you've deposited into a pool changes after your deposit. The pool is designed to maintain a specific ratio, typically 50/50, between the assets it holds. When the price of one asset increases relative to the other, the pool automatically rebalances itself by selling some of the higher-priced asset and buying more of the lower-priced asset. This rebalancing mechanism ensures that the pool always maintains the target ratio, but it also means that you might end up with fewer of the appreciating asset and more of the depreciating asset than if you had simply held the assets in your own wallet.

The term "impermanent" loss comes from the fact that this loss is only realized if you withdraw your liquidity from the pool. If the price ratio of the assets reverts back to its original state before you withdraw, the loss will disappear. However, if you withdraw your liquidity while the price ratio is still different from its original state, you will incur a real loss. The amount of impermanent loss you experience depends on the magnitude of the price divergence between the assets. The greater the divergence, the greater the potential loss. However, it's important to remember that the rewards you earn from swap fees and RUNE emissions can often offset the impermanent loss. In many cases, liquidity providers earn enough rewards to compensate for the impermanent loss and still generate a profit. Therefore, it's crucial to carefully consider the potential risks and rewards before providing liquidity to any pool.

Fun Facts of THORChain

Did you know that the THORChain team operates under a pseudo-anonymous structure? The core developers are known as "RUNE Marines," and they prefer to maintain a level of anonymity to protect themselves from potential legal or regulatory scrutiny. This decentralized and anonymous approach aligns with the ethos of the broader crypto community. Another fun fact is that THORChain's native token, RUNE, is named after the ancient Norse runes, which were used for divination and communication. This ties into the project's overall theme of bridging different realms and connecting disparate worlds.

THORChain's architecture is designed to be highly resilient and fault-tolerant. The network is composed of a network of independent nodes that are geographically distributed around the world. This ensures that the network can continue to operate even if some nodes go offline or are attacked. THORChain is constantly evolving and improving. The team is actively working on new features and upgrades to enhance the network's functionality, security, and scalability. This commitment to continuous improvement is essential for ensuring the long-term success of the project. Finally, THORChain has a strong and supportive community of users, developers, and node operators. The community is actively involved in the project's governance and development, and they are passionate about promoting the adoption of cross-chain De Fi.

How to Use THORChain

To start using THORChain, you'll need a wallet that supports the network. Some popular options include Trust Wallet, Ledger, and Trezor. Once you have a compatible wallet, you can connect it to one of the THORChain interfaces, such as THORSwap or BEPSwap. These interfaces provide a user-friendly way to interact with the THORChain network.

To swap assets, simply select the asset you want to swap and the asset you want to receive. The interface will then display the estimated exchange rate and the fees involved. Once you confirm the transaction, the swap will be executed on the THORChain network. To provide liquidity to the pools, you'll need to deposit an equal value of RUNE and the other asset into the pool. For example, if you want to provide liquidity to the BTC/RUNE pool, you'll need to deposit an equal value of BTC and RUNE. Once you have deposited your assets, you'll start earning rewards in the form of swap fees and RUNE emissions. To withdraw your liquidity, simply select the pool you want to withdraw from and specify the amount of liquidity you want to withdraw. The interface will then calculate the amount of assets you'll receive back. It's important to note that withdrawing liquidity can result in impermanent loss if the price of the assets has diverged since you deposited them.

What if...?

What if THORChain becomes the dominant cross-chain liquidity protocol in the De Fi space? Imagine a world where you can seamlessly trade any digital asset on any blockchain without the need for wrapped tokens or bridges. This would unlock a new level of interoperability and efficiency in the crypto ecosystem, making it easier for users to access and utilize their digital assets. What if THORChain's security model proves to be more robust than traditional bridging solutions? This would significantly reduce the risk of hacks and exploits, making De Fi more secure and accessible for a wider range of users.

What if THORChain attracts a large and vibrant community of developers, node operators, and liquidity providers? This would foster innovation and drive the continued development of the protocol, leading to new features and improvements. What if THORChain integrates with other De Fi protocols and platforms? This would create a more interconnected and collaborative ecosystem, allowing users to seamlessly access and utilize different De Fi services. What if THORChain becomes a key infrastructure component for the next generation of decentralized applications? This would position THORChain as a vital player in the future of finance, enabling a more open, transparent, and accessible financial system for everyone.

Listicle of THORChain

Here's a quick list of reasons why you might want to consider using THORChain:

1.Native Cross-Chain Swaps: Trade assets directly on their native blockchains without wrapped tokens or bridges.

2.Decentralized and Permissionless: No need for trusted custodians or intermediaries.

3.Secure and Transparent: Built on a robust and auditable code base with economic incentives for honest behavior.

4.Efficient and Scalable: Designed to handle high transaction volumes with low fees.

5.Earn Rewards: Provide liquidity to the pools and earn swap fees and RUNE emissions.

6.Interoperability: Supports a wide range of blockchains, including Bitcoin, Ethereum, and Binance Chain.

7.Community-Driven: Actively developed and governed by a passionate community of users and developers.

8.Innovation: Constantly evolving and improving with new features and upgrades.

9.Potential for Growth: Positioned to become a key infrastructure component in the De Fi space.

10.Accessibility: Easy to use interfaces make it accessible for both beginners and experienced crypto users.

Question and Answer

Q: What is the RUNE token and what is its purpose?

A: RUNE is the native token of the THORChain network and plays a vital role in its security and governance. It is used to incentivize node operators, reward liquidity providers, and participate in the network's decision-making processes.

Q: What is impermanent loss and how can I mitigate it?

A: Impermanent loss occurs when the price of the assets in a liquidity pool diverge, resulting in a temporary loss of value. To mitigate impermanent loss, choose assets that you are comfortable holding for the long term and diversify your liquidity positions across different pools.

Q: Is THORChain secure?

A: THORChain is designed to be highly secure, with economic incentives for honest behavior and penalties for malicious activity. The smart contracts have been audited by reputable firms, and the network is constantly monitored for potential vulnerabilities. However, like any decentralized protocol, it carries certain risks, so it's important to do your own research and understand the risks involved.

Q: How can I get involved in the THORChain community?

A: You can get involved in the THORChain community by following the project's official channels, such as their website, Twitter, and Telegram. You can also participate in the community forums and contribute to the project's development.

Conclusion of THORChain Tutorial: Cross-Chain Swaps Without Wrapped Tokens or Bridges

THORChain represents a significant leap forward in the world of decentralized finance, offering a compelling solution for cross-chain swaps without the need for wrapped tokens or bridges. Its innovative architecture, robust security model, and community-driven approach make it a promising platform for the future of De Fi. By understanding the core concepts and functionalities of THORChain, you can unlock the potential of native asset swaps and participate in a more interconnected and efficient crypto ecosystem. While it's essential to be aware of the inherent risks, the rewards of seamless cross-chain trading and contributing to a truly decentralized network are undeniable. As THORChain continues to evolve and mature, it has the potential to revolutionize the way we interact with digital assets, fostering a more open, transparent, and accessible financial system for everyone.

Post a Comment