Polygon Network Tutorial: Bridge Ethereum & Use Layer 2 DeFi Applications

Ever felt like you're stuck in rush hour traffic every time you try to do something on Ethereum? The gas fees are high, and transactions take forever. It can feel like you're constantly paying a premium just to participate in the decentralized world.

Imagine wanting to explore the exciting world of De Fi, but being held back by slow transaction speeds and exorbitant costs. The dream of easily accessing various De Fi applications can quickly turn into a frustrating experience, leaving you feeling excluded from the innovation happening in the Layer 2 space. It's like having a sports car, but only being able to drive it on a bumpy, congested road.

This guide will walk you through how to bridge your Ethereum assets to Polygon Network, unlocking a faster and more affordable De Fi experience. We'll show you step-by-step how to move your ETH and other tokens and start exploring the growing ecosystem of Polygon-based De Fi applications. Ready to leave those high gas fees behind?

In this tutorial, we'll cover the process of bridging Ethereum assets to the Polygon Network, providing a step-by-step guide to navigate the Polygon bridge. We'll explore the benefits of Layer 2 scaling solutions like Polygon, focusing on reduced transaction costs and faster speeds. You'll learn how to access and utilize various De Fi applications on the Polygon network, enhancing your overall De Fi experience. The key topics are Ethereum, Polygon Network, bridging, Layer 2, De Fi applications, and transaction costs.

Bridging Ethereum to Polygon: A Step-by-Step Guide

Bridging your assets from Ethereum to Polygon can initially seem daunting. I remember the first time I attempted it; I was nervous about potentially losing my funds. I spent hours researching different bridges and carefully reading through documentation before taking the plunge. Thankfully, the process is now much more streamlined, and with the right guidance, it's quite straightforward. Before initiating the transfer, make sure that the amount of the money you are sending will make sense considering the gas fees to send it. Otherwise, it makes no sense to send 10 dollars if the gas fees is going to be 15 dollars. Now, you can finally enjoy the beauty of Polygon and enjoy the low fees and speedy transactions.

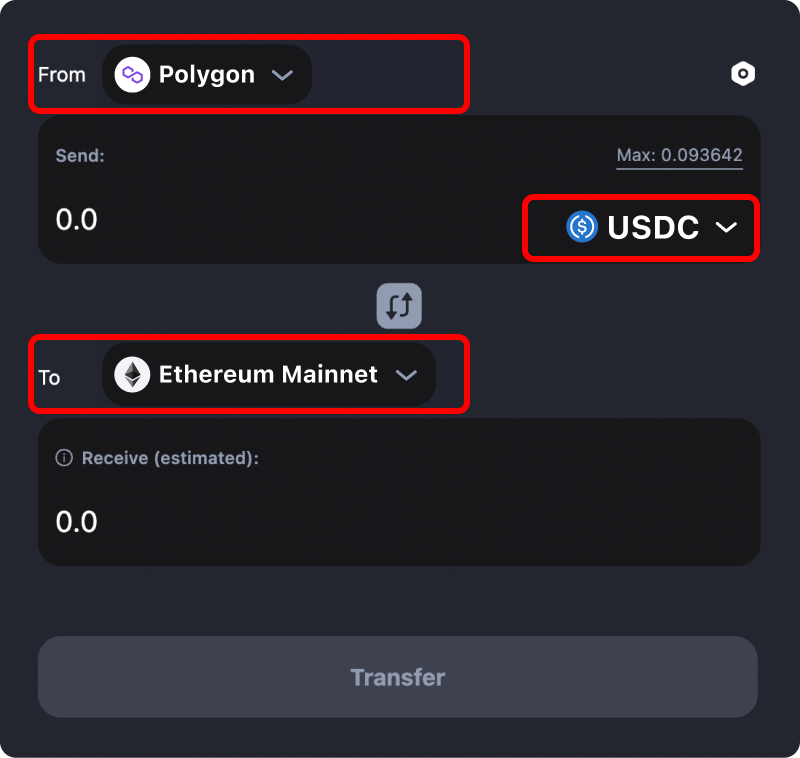

The first step involves using a bridge – a tool that allows you to move your tokens from one blockchain to another. The official Polygon Bridge is a popular choice, and many third-party bridges like Hop Protocol also offer this functionality. Once you've chosen a bridge, connect your Ethereum wallet (like Meta Mask) to the platform. Then, select the token you wish to transfer and the amount. The bridge will guide you through the process, which typically involves approving the transaction in your wallet and waiting for the transfer to complete. It's crucial to double-check the destination address to ensure your funds arrive safely on the Polygon side.

After your assets are successfully bridged, you'll need to add the Polygon Network to your Meta Mask wallet. This allows you to interact with De Fi applications on Polygon. You can easily add the network manually or use a service like Chainlist to add it automatically. Once added, you can switch to the Polygon Network within your Meta Mask wallet and see your transferred assets. Now you're ready to explore the vast ecosystem of De Fi applications on Polygon, including lending platforms, decentralized exchanges, and yield farms, all with significantly lower fees and faster transaction times compared to Ethereum.

Understanding Layer 2 Scaling Solutions

Layer 2 scaling solutions are like adding express lanes to a congested highway. They operate on top of the main Ethereum blockchain (Layer 1) to handle transactions more efficiently, reducing congestion and lowering fees. Polygon is one such solution, utilizing a Proof-of-Stake (Po S) consensus mechanism to achieve faster transaction speeds and lower costs. By offloading transaction processing to a separate chain, Layer 2 solutions alleviate the burden on the main Ethereum network, making De Fi more accessible to a wider range of users.

Polygon achieves this efficiency through a combination of technologies, including its own version of the Ethereum Virtual Machine (EVM), which allows developers to easily port their existing Ethereum applications to the Polygon Network. This compatibility has led to a rapid growth in the Polygon ecosystem, with many popular De Fi protocols, such as Aave and Curve, deploying versions of their platforms on Polygon. This allows users to interact with these familiar protocols with the same level of security and functionality but at a fraction of the cost. One of the things to consider here is that you are using the same interface, however the technology underneath it is different.

The key advantage of Layer 2 solutions like Polygon is their ability to drastically reduce transaction fees. On Ethereum, a simple token swap on a decentralized exchange can cost upwards of $10, while on Polygon, the same transaction might cost only a few cents. This makes De Fi accessible to users with smaller portfolios, who might otherwise be priced out of the Ethereum ecosystem. Furthermore, Layer 2 solutions can significantly improve transaction speeds, reducing the time it takes to confirm a transaction from minutes to seconds. This enhanced user experience is crucial for widespread adoption of De Fi and Web3 technologies.

The History and Myth of Polygon Network

The story of Polygon Network, previously known as Matic Network, is a fascinating tale of innovation and problem-solving in the blockchain space. Founded in 2017 by Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun, the project initially focused on providing a Layer 2 scaling solution for Ethereum, aiming to address the network's persistent issues with scalability and high gas fees. The founders recognized early on that Ethereum's limitations were hindering the mass adoption of decentralized applications, and they set out to build a platform that could overcome these challenges.

The initial Matic Network focused on providing a Plasma-based scaling solution, but the team quickly realized that a more flexible and versatile approach was needed. This led to the development of the Polygon SDK, which allows developers to easily build and deploy various types of Layer 2 solutions, including sidechains, Optimistic Rollups, and zk-Rollups. This modular approach has made Polygon a hub for innovation in the Ethereum scaling space, attracting a wide range of projects and developers to its ecosystem. The rebrand to Polygon in early 2021 reflected this broader vision of becoming a multi-chain system, connecting and scaling Ethereum-compatible blockchains.

One of the myths surrounding Polygon is that it's a completely separate blockchain from Ethereum. While Polygon operates as a separate chain with its own consensus mechanism, it's deeply integrated with Ethereum, acting as a scaling solution that enhances the performance of the main network. Assets are bridged between Ethereum and Polygon, and Polygon transactions are ultimately secured by Ethereum's underlying infrastructure. This symbiotic relationship makes Polygon an integral part of the Ethereum ecosystem, contributing to its growth and accessibility. The vision of Polygon's founders has transformed the project into a major player in the blockchain industry, paving the way for a more scalable and affordable future for decentralized applications.

Unveiling the Hidden Secrets of Polygon

While Polygon presents itself as a straightforward Layer 2 scaling solution, there are some lesser-known aspects that contribute to its success and appeal. One of the hidden secrets is the versatility of its architecture. Polygon isn't just a single chain; it's a framework for building interconnected blockchain networks. This allows developers to customize their Layer 2 solutions to meet the specific needs of their applications, whether it's prioritizing transaction speed, security, or decentralization.

Another hidden advantage is Polygon's commitment to interoperability. The Polygon team is actively working on connecting Polygon to other blockchain networks, creating a more seamless and interconnected Web3 ecosystem. This includes building bridges to other Layer 1 blockchains, as well as developing cross-chain communication protocols that allow applications on different networks to interact with each other. This focus on interoperability is crucial for fostering collaboration and innovation across the blockchain space, unlocking new possibilities for decentralized applications.

Furthermore, Polygon's community is a significant, often overlooked, strength. The Polygon ecosystem has a large and active community of developers, users, and validators who are passionate about the project's mission. This community provides valuable support, feedback, and resources to the Polygon team, helping to drive the network's growth and development. The open-source nature of the Polygon project also encourages community contributions, allowing developers to contribute to the codebase and propose new features. This collaborative spirit is essential for the long-term success of any blockchain project, and it's one of the key factors that sets Polygon apart from its competitors.

Recommended Uses for Polygon Network

Polygon Network is best recommended for anyone seeking to engage with De Fi applications without incurring the exorbitant costs associated with Ethereum mainnet. If you're a frequent user of decentralized exchanges like Uniswap or Sushi Swap, bridging your assets to Polygon can significantly reduce your transaction fees, allowing you to trade more frequently and with smaller amounts. Similarly, if you're interested in participating in yield farming or lending protocols, Polygon offers a more affordable environment for these activities.

Polygon is also a great option for developers who are looking to build and deploy decentralized applications. Its compatibility with the Ethereum Virtual Machine (EVM) makes it easy to port existing Ethereum applications to Polygon, and its lower transaction fees can attract a wider user base. Furthermore, Polygon's modular architecture allows developers to customize their Layer 2 solutions to meet the specific needs of their applications. I used Polygon a lot when I was developing my NFT project, and this saved me a ton of money.

Beyond De Fi, Polygon is also well-suited for gaming and NFT applications. The faster transaction speeds and lower fees make it ideal for in-game transactions and the minting and trading of NFTs. Many popular blockchain games and NFT marketplaces have already deployed on Polygon, offering users a more seamless and affordable experience. Whether you're a seasoned De Fi enthusiast or a newcomer to the blockchain space, Polygon provides a valuable entry point into the world of decentralized applications, offering a faster, cheaper, and more accessible alternative to Ethereum mainnet.

Deep Dive into Polygon's Architecture

Polygon's architecture is designed for flexibility and scalability, allowing developers to choose the Layer 2 solution that best suits their needs. At its core, Polygon is a framework for building interconnected blockchain networks, each with its own consensus mechanism and governance model. This modular approach allows developers to customize their Layer 2 solutions to meet the specific requirements of their applications, whether it's prioritizing transaction speed, security, or decentralization.

One of the key components of Polygon's architecture is its Plasma chain, which is a sidechain that processes transactions off-chain and periodically commits the results to the Ethereum mainnet. This reduces the burden on the main Ethereum network and allows for faster transaction speeds and lower fees. Polygon also supports other Layer 2 solutions, such as Optimistic Rollups and zk-Rollups, which offer different trade-offs between scalability and security. I understand that zk-Rollups are very secure and I am willing to bet that this is the next evolution of blockchain.

Polygon's architecture also includes a bridge that allows users to transfer assets between Ethereum and Polygon. This bridge is crucial for allowing users to access the De Fi applications and other services available on Polygon. The bridge operates by locking tokens on the Ethereum side and minting equivalent tokens on the Polygon side. When users want to withdraw their assets from Polygon, the tokens on the Polygon side are burned, and the corresponding tokens on the Ethereum side are unlocked. This mechanism ensures that the supply of tokens on both chains remains consistent. This architecture that Polygon built is absolutely amazing.

Tips for Using Polygon Network Effectively

To make the most of your experience on the Polygon Network, there are a few key tips to keep in mind. First, always double-check the network you're connected to in your wallet before initiating a transaction. Accidentally sending a transaction to the Ethereum mainnet instead of Polygon can result in high gas fees and delays. It's a mistake that even seasoned De Fi users occasionally make, so it's always worth double-checking.

Second, be aware of the different bridges available for transferring assets between Ethereum and Polygon. While the official Polygon Bridge is a reliable option, other third-party bridges like Hop Protocol and Anyswap may offer faster transfer times or lower fees. Compare the options available and choose the bridge that best suits your needs. Remember to research the bridge you will use to make sure it's safe. Never use a bridge that looks shady.

Third, familiarize yourself with the different De Fi applications available on Polygon. Many popular De Fi protocols, such as Aave and Curve, have deployed versions of their platforms on Polygon, offering users a more affordable alternative to Ethereum mainnet. Explore the ecosystem and discover the various opportunities for yield farming, lending, and borrowing. Remember to do your own research and understand the risks involved before investing in any De Fi protocol. The reward will also include the risk when it comes to De Fi. So do your own research is really important.

Understanding the MATIC Token

The MATIC token is the native cryptocurrency of the Polygon Network and plays a crucial role in the ecosystem's functionality. It serves several key purposes, including securing the network through staking, paying transaction fees, and participating in governance. By staking MATIC, users can help validate transactions and earn rewards, contributing to the overall security and decentralization of the network.

The MATIC token is also used to pay for transaction fees on the Polygon Network. Because Polygon has lower transaction costs than the Ethereum mainnet, MATIC allows users to perform transactions without paying exorbitant fees. Also, because of the low fees, you're going to do more transactions than on the mainnet. I think it's a win-win situation.

MATIC holders can participate in the governance of the Polygon Network, voting on proposals to improve the network and shape its future direction. This governance mechanism allows the community to have a voice in the development of the Polygon ecosystem, ensuring that it remains aligned with the needs of its users. The MATIC token is an essential component of the Polygon Network, facilitating its operation and empowering its community.

Fun Facts About Polygon Network

Did you know that Polygon was originally called Matic Network? The rebranding in early 2021 reflected the project's broader vision of becoming a multi-chain system, connecting and scaling Ethereum-compatible blockchains. Another fun fact is that Polygon is home to a diverse ecosystem of De Fi applications, NFT marketplaces, and blockchain games, offering users a wide range of opportunities to engage with the decentralized world. All those different types of blockchains are the reason why I love crypto.

Polygon's founders, Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun, are all experienced blockchain developers who recognized the need for a scalable and affordable solution for Ethereum. Their vision and expertise have been instrumental in the success of Polygon. I admire their contribution to the blockhain world.

Polygon has partnered with many well-known companies and projects in the blockchain space, including Chainlink, Aave, and Curve. These partnerships have helped to expand the Polygon ecosystem and increase its adoption. As more and more projects adopt Polygon, its potential for growth and innovation continues to increase. It's exciting to see how Polygon will continue to evolve and shape the future of the blockchain industry.

How to Start Using De Fi Applications on Polygon

Getting started with De Fi applications on Polygon is relatively straightforward. First, you'll need to bridge your assets from Ethereum to Polygon using a bridge like the official Polygon Bridge or Hop Protocol. Once your assets are on Polygon, you can connect your wallet to various De Fi applications and start exploring the ecosystem.

One of the most popular De Fi applications on Polygon is Aave, a lending and borrowing protocol that allows users to earn interest on their deposits or borrow assets against their collateral. Another popular option is Curve, a decentralized exchange that specializes in stablecoin swaps. Curve offers low slippage and high liquidity for stablecoin trading, making it an ideal platform for users who want to minimize price volatility.

When using De Fi applications on Polygon, it's important to understand the risks involved. De Fi protocols are often complex and can be vulnerable to exploits or hacks. Before investing in any De Fi protocol, do your own research and understand the potential risks. It's also a good idea to start with small amounts and gradually increase your investments as you become more comfortable with the platform. The general rule is to only put in what you can afford to lose.

What If Polygon Didn't Exist?

Imagine a world where Polygon didn't exist. The Ethereum network would likely be even more congested and expensive to use. De Fi applications would remain largely inaccessible to the average user due to high gas fees. The growth of the Web3 ecosystem would be significantly slower, as developers would struggle to build and deploy scalable applications on Ethereum.

Polygon has played a crucial role in making De Fi more accessible and affordable to a wider range of users. By providing a Layer 2 scaling solution for Ethereum, Polygon has enabled faster transaction speeds and lower fees, making it possible for users with smaller portfolios to participate in the De Fi ecosystem. Without Polygon, the benefits of De Fi would be limited to a small group of wealthy investors.

Furthermore, Polygon has fostered innovation in the blockchain space by providing a platform for developers to build and deploy scalable applications. Its compatibility with the Ethereum Virtual Machine (EVM) makes it easy for developers to port their existing Ethereum applications to Polygon, and its modular architecture allows them to customize their Layer 2 solutions to meet the specific needs of their applications. Without Polygon, the pace of innovation in the blockchain industry would likely be slower.

List of Popular De Fi Applications on Polygon

Here's a list of some popular De Fi applications on Polygon: Aave, Curve, Sushi Swap, Quick Swap, Balancer, Beefy Finance, and Iron Finance. Aave is a lending and borrowing protocol that allows users to earn interest on their deposits or borrow assets against their collateral. Curve is a decentralized exchange that specializes in stablecoin swaps. Sushi Swap and Quick Swap are decentralized exchanges that offer a wide range of token trading pairs. Balancer is a decentralized exchange that allows users to create and manage their own liquidity pools. Beefy Finance is a yield optimizer that automatically compounds users' yield farming rewards. Iron Finance offers yield farming opportunities with its partially collateralized stablecoin protocol.

These De Fi applications offer a variety of opportunities for users to earn yield, trade tokens, and participate in the decentralized economy. The APYs are very tempting and the transaction fees is only a few cents. So these all become good platforms to use.

It's important to note that all De Fi protocols carry risks, and users should do their own research before investing in any platform. Understand the potential risks, such as smart contract vulnerabilities and impermanent loss, before committing your funds. Start with small amounts and gradually increase your investments as you become more comfortable with the platform. Always monitor your positions and be aware of market conditions.

Question and Answer

Q: What is the Polygon Network?

A: Polygon Network is a Layer 2 scaling solution for Ethereum that enables faster transaction speeds and lower fees. It operates as a separate chain that is connected to Ethereum, allowing users to transfer assets between the two networks.

Q: How do I bridge my assets from Ethereum to Polygon?

A: You can use a bridge like the official Polygon Bridge or Hop Protocol to transfer your assets from Ethereum to Polygon. Connect your wallet to the bridge, select the token you want to transfer, and follow the instructions to complete the transaction.

Q: What are the benefits of using De Fi applications on Polygon?

A: The main benefits of using De Fi applications on Polygon are lower transaction fees and faster transaction speeds compared to Ethereum mainnet. This makes De Fi more accessible and affordable to a wider range of users.

Q: What are some popular De Fi applications on Polygon?

A: Some popular De Fi applications on Polygon include Aave, Curve, Sushi Swap, and Quick Swap. These platforms offer a variety of opportunities for users to earn yield, trade tokens, and participate in the decentralized economy.

Conclusion of Polygon Network Tutorial: Bridge Ethereum & Use Layer 2 De Fi Applications

Bridging your assets to Polygon and exploring its De Fi ecosystem opens up a world of possibilities. By bypassing the high gas fees and slow transaction times of Ethereum mainnet, you can engage with De Fi applications more frequently and with smaller amounts. This tutorial has provided you with the knowledge and steps to confidently navigate the Polygon Network, unlock its potential, and enhance your overall De Fi experience. So go forth and explore the world of Polygon, and discover the benefits of a faster, cheaper, and more accessible De Fi experience!

Post a Comment