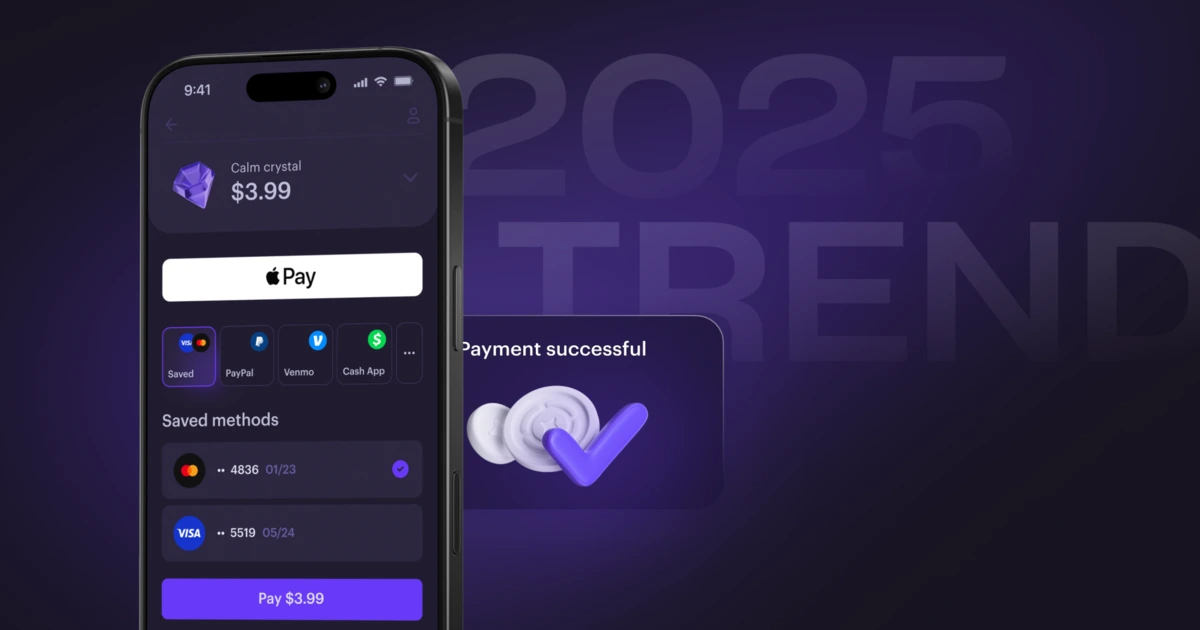

Digital Currency Adoption: Mainstream Payment Trends 2025

Imagine a world where your morning coffee, your online shopping spree, and even your rent are all paid for with a few taps on your phone using digital currencies. Sounds futuristic, right? But the future might be closer than you think, and understanding the evolving landscape of digital payments is crucial for everyone, from business owners to everyday consumers.

The shift towards digital currencies isn't without its challenges. There are concerns about security, regulatory uncertainty, and the learning curve associated with new technologies. People often feel uneasy about entrusting their finances to something they don't fully understand.

This article aims to explore the potential for digital currency adoption to become a mainstream payment trend by 2025. We'll delve into the drivers behind this shift, the technologies enabling it, and the implications for businesses and consumers alike.

In essence, this article unpacks the trajectory of digital currencies toward broader acceptance. We examine the advancements in blockchain technology, the increasing regulatory clarity (or lack thereof), and the growing consumer appetite for alternative payment methods. Keywords like cryptocurrency, blockchain, digital payments, and fintech are central to this discussion.

The Rise of Stablecoins

My first real brush with stablecoins was during a trip to El Salvador. Seeing businesses readily accepting Bitcoin, often facilitated by stablecoin conversions, opened my eyes to their potential. The volatility of Bitcoin itself can be a deterrent for everyday transactions, but stablecoins, pegged to a more stable asset like the US dollar, offer a bridge between the crypto world and traditional finance. It made me realize that stablecoins weren't just some niche crypto product, they were a tool for real-world financial inclusion.

Stablecoins are designed to maintain a stable value, often pegged to a fiat currency like the US dollar. This stability makes them more suitable for everyday transactions compared to volatile cryptocurrencies like Bitcoin. Their rise is fueled by the need for a digital currency that can be used for payments without the price fluctuations associated with other cryptocurrencies. As regulatory frameworks become clearer and more stablecoins emerge with robust backing, their adoption for mainstream payments is likely to increase significantly by 2025.

Decentralized Finance (De Fi) and Payments

Decentralized Finance, or De Fi, refers to financial services built on blockchain technology, operating without intermediaries like banks or traditional financial institutions. It encompasses a wide range of applications, including lending, borrowing, trading, and payments. In the context of mainstream payments, De Fi offers the potential for lower transaction fees, faster processing times, and greater accessibility, particularly for those underserved by traditional banking systems.

The myth surrounding De Fi is that it's a Wild West of unregulated activity, accessible only to tech-savvy individuals. While there are risks associated with De Fi, the potential benefits are significant, especially for individuals in areas with limited access to traditional financial services. As De Fi platforms become more user-friendly and regulatory oversight increases, we can expect to see De Fi solutions integrated into mainstream payment systems, enabling users to send and receive payments globally at a fraction of the cost of traditional methods.

The Regulatory Landscape

One of the biggest hurdles to digital currency adoption is the lack of clear regulatory guidelines. Uncertainty about how digital currencies are classified, taxed, and regulated creates hesitation among businesses and consumers alike. Many businesses are reluctant to accept digital currencies as payment if they are unsure of the legal implications.

The hidden secret to widespread digital currency adoption lies in regulatory clarity. Governments around the world are grappling with how to regulate this nascent industry, and the outcomes of these regulatory efforts will significantly impact the future of digital payments. If regulations are overly restrictive, they could stifle innovation and limit adoption. Conversely, clear and well-defined regulations could provide the confidence and security needed for businesses and consumers to embrace digital currencies as a mainstream payment method. It's a delicate balance, and the next few years will be critical in shaping the regulatory landscape.

Recommendations for Businesses

For businesses looking to position themselves for the future of payments, exploring digital currency adoption is crucial. Start by understanding the different types of digital currencies and their potential benefits for your business. Consider integrating payment gateways that support digital currency transactions.

My recommendation for businesses is to start small. Begin by accepting a popular stablecoin like USDC alongside traditional payment methods. This allows you to dip your toes in the water without taking on excessive risk. Monitor customer demand and gather feedback to inform your future strategy. Educate your staff about digital currencies and how to handle transactions. By taking a measured and informed approach, businesses can capitalize on the growing trend of digital currency adoption and gain a competitive edge.

Security Considerations

Security is paramount when dealing with digital currencies. Businesses must implement robust security measures to protect their funds and customer data. This includes using secure wallets, enabling two-factor authentication, and regularly auditing their systems for vulnerabilities.

Digital currency transactions are irreversible, making it crucial to protect against fraud and hacking. Educating your staff about security best practices is essential. Implement multi-signature wallets, requiring multiple approvals for transactions. Partner with reputable security firms to conduct regular security assessments. By prioritizing security, businesses can mitigate the risks associated with digital currencies and build trust with their customers.

Consumer Education is Key

A significant barrier to digital currency adoption is a lack of understanding among consumers. Many people are unfamiliar with the technology and perceive it as complex and risky. Education is crucial to overcoming this barrier and fostering wider acceptance.

Tips for consumers include starting with small amounts and gradually increasing their exposure to digital currencies as they become more comfortable. Research different digital currencies and understand their underlying technology. Use reputable wallets and exchanges with strong security measures. Be wary of scams and never share your private keys with anyone. By educating themselves and taking precautions, consumers can confidently participate in the digital currency revolution.

The Role of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies, or CBDCs, are digital forms of a country's fiat currency issued and regulated by its central bank. They represent a digital version of cash and could potentially revolutionize the payment landscape.

CBDCs have the potential to streamline payments, reduce transaction costs, and increase financial inclusion. They could also provide central banks with greater control over monetary policy. However, CBDCs also raise concerns about privacy and security. As governments around the world explore the possibility of issuing CBDCs, it's important to consider the potential benefits and risks. The introduction of CBDCs could significantly accelerate the adoption of digital payments and reshape the future of finance.

Fun Facts About Digital Currency Adoption

Did you know that El Salvador was the first country to adopt Bitcoin as legal tender? Or that some retailers are using blockchain technology to track the provenance of their products, ensuring authenticity and ethical sourcing? The world of digital currencies is full of fascinating developments.

One fun fact is that the first purchase made with Bitcoin was for two pizzas, costing 10,000 BTC, which would be worth hundreds of millions of dollars today. These stories highlight the transformative potential of digital currencies and their ability to disrupt traditional industries. From revolutionizing cross-border payments to creating new forms of digital art, the possibilities are endless.

How to Get Started with Digital Currencies

Getting started with digital currencies can seem daunting, but it doesn't have to be. The first step is to educate yourself about the different types of digital currencies and their underlying technology. There are numerous online resources, including articles, videos, and courses, that can help you learn the basics.

Once you have a basic understanding, you can create a wallet to store your digital currencies. Choose a reputable wallet with strong security features. You can then purchase digital currencies on an exchange or through a peer-to-peer transaction. Start with small amounts and gradually increase your exposure as you become more comfortable. By taking a measured and informed approach, anyone can participate in the digital currency revolution.

What If Digital Currency Adoption Fails?

While the potential benefits of digital currency adoption are significant, it's important to consider the potential downsides. What if digital currencies fail to gain mainstream acceptance? What if regulatory hurdles prove insurmountable? What if security vulnerabilities undermine trust in the system?

If digital currency adoption falters, the potential benefits of faster, cheaper, and more accessible payments could be lost. Innovation in the financial technology sector could be stifled. The gap between the banked and the unbanked could widen. While the future is uncertain, it's important to carefully consider the potential risks and challenges associated with digital currencies and work towards creating a sustainable and responsible ecosystem.

Top 5 Digital Currency Trends to Watch in 2025

Here is a quick look at some top trends to consider:

- Increased Adoption of Stablecoins: As mentioned earlier, stablecoins are gaining traction as a practical payment method due to their price stability.

- Growth of CBDCs: Several countries are exploring the launch of their own digital currencies.

- De Fi Integration: Decentralized finance is becoming more accessible and user-friendly.

- Cross-Border Payment Solutions: Digital currencies are streamlining international transactions.

- Greater Regulatory Clarity: Regulations are gradually becoming clearer, providing a more secure environment.

Question and Answer Section

Here are some common questions people have about digital currency adoption:

Question 1: Is digital currency adoption safe?

Answer: It can be, but it's essential to take precautions. Use reputable wallets and exchanges, enable two-factor authentication, and be wary of scams.

Question 2: What are the benefits of using digital currencies?

Answer: Digital currencies can offer faster, cheaper, and more accessible payments, especially for international transactions.

Question 3: How can businesses benefit from accepting digital currencies?

Answer: Businesses can attract new customers, reduce transaction fees, and improve cash flow by accepting digital currencies.

Question 4: Will digital currencies replace traditional payment methods?

Answer: It's unlikely that digital currencies will completely replace traditional payment methods, but they are expected to play an increasingly important role in the future of finance.

Conclusion of Digital Currency Adoption: Mainstream Payment Trends 2025

The road to widespread digital currency adoption may have its bumps, but the direction is clear. With ongoing innovation, growing regulatory clarity, and increasing consumer awareness, digital currencies are poised to become a mainstream payment trend by 2025. Embracing this change requires education, adaptation, and a willingness to explore the possibilities of a digital future.

Post a Comment