DAO Investment Opportunities: Best Projects 2025

Imagine a world where your investment decisions aren't dictated by Wall Street gurus, but by a collective intelligence, a community-driven force shaping the future of finance. That future is unfolding right now, and it's powered by DAOs.

Navigating the emerging world of Decentralized Autonomous Organizations can feel like wandering through a maze. There's a lack of clear direction, an overwhelming amount of information, and the constant worry of making the wrong turn. Knowing where to put your capital and how to assess risk in these new structures can be daunting.

This article aims to cut through the noise and provide a clear roadmap to the best DAO investment opportunities expected to emerge in 2025. We'll explore promising projects, discuss key factors for evaluation, and offer insights to help you confidently participate in this revolutionary investment landscape.

We'll delve into the exciting realm of DAO investment, uncovering promising projects anticipated to shine in 2025. We will discuss criteria for evaluating these ventures, the historical context shaping them, and tips for successful navigation. This landscape includes diverse opportunities from De Fi protocols to NFT collectives, all seeking to redefine how we invest and collaborate. Keywords: DAO, investment, decentralized, autonomous, projects, 2025, De Fi, NFT, governance.

Unveiling the DAO Landscape: A Personal Journey

I remember when I first stumbled upon DAOs. I was initially skeptical, another buzzword in the crypto space, I thought. But after diving in, participating in governance votes, and witnessing the power of collective decision-making, I was hooked. My initial investment in a small De Fi DAO yielded surprising returns, not just financially, but in terms of knowledge and community connection. That experience fueled my desire to understand this space better and share my learnings with others.

DAO investment opportunities are evolving rapidly. Projects in 2025 are likely to be more sophisticated, with robust governance mechanisms, clearer value propositions, and a stronger focus on sustainability. We'll see DAOs focused on venture capital, funding early-stage startups, acquiring and managing digital assets like NFTs, and even governing real-world assets through tokenization. The key is to identify DAOs with strong leadership, active communities, and a clear path to profitability. Look for projects that address real-world problems or offer innovative solutions in areas like De Fi, metaverse, or social impact. Due diligence is paramount. Understanding the underlying technology, tokenomics, and the team behind the DAO is crucial for making informed investment decisions. Assess the risks involved, including smart contract vulnerabilities, regulatory uncertainties, and the potential for internal conflicts. Remember, the DAO space is still young, so patience and a long-term perspective are essential.

What Exactly Are DAO Investment Opportunities?

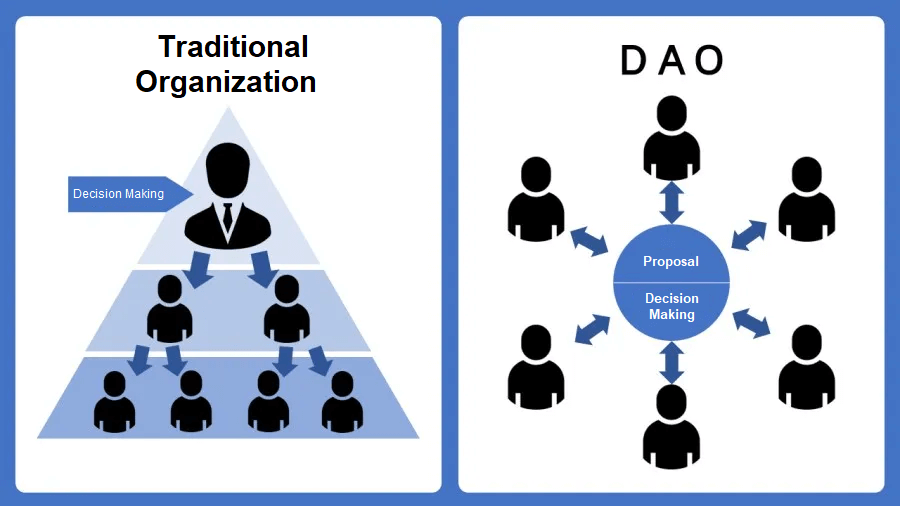

DAO investment opportunities essentially refer to the ability to invest in projects and organizations that are governed by a decentralized, autonomous structure. Instead of traditional hierarchical management, decisions are made collectively by token holders through voting mechanisms. This opens up a whole new world of investment possibilities, allowing individuals to participate in ventures that were previously inaccessible or controlled by a select few.

These opportunities span across various sectors, from De Fi protocols offering tokenized governance and yield farming opportunities to NFT collectives pooling resources to acquire valuable digital art. DAOs can also focus on venture capital, funding early-stage crypto projects, or even real estate, tokenizing properties and allowing for fractional ownership. The key attraction lies in the transparency, community-driven decision-making, and potential for high returns. However, it's crucial to understand the risks involved. DAO investments are often tied to volatile crypto assets, and the regulatory landscape is still evolving. Smart contract vulnerabilities and the potential for governance manipulation are also factors to consider. Therefore, thorough research and risk assessment are paramount before diving into any DAO investment opportunity. Consider the DAO's governance model, tokenomics, the team behind it, and the overall market conditions before making any decisions.

The History and Mythology of DAO Investing

The history of DAO investment is relatively short, but filled with impactful events. The story often begins with "The DAO," an ambitious project launched in 2016 that aimed to be a decentralized venture capital fund. While ultimately unsuccessful due to a critical security flaw, it laid the groundwork for the DAO concept and sparked widespread interest. The failure of "The DAO" also highlighted the importance of smart contract security and the need for robust governance mechanisms.

In the years that followed, the DAO landscape evolved significantly. We saw the rise of De Fi DAOs, managing decentralized exchanges, lending platforms, and other financial protocols. These DAOs often offered token holders the opportunity to earn rewards by participating in governance and providing liquidity. NFT DAOs also emerged, focusing on collecting and managing digital art, creating communities around specific NFT projects, and exploring new ways to monetize digital assets. The "mythology" of DAO investing often revolves around the promise of democratized finance, where anyone can participate in shaping the future of innovative projects. However, it's crucial to separate the hype from reality. While DAOs offer exciting possibilities, they also come with inherent risks. Understanding the history and the lessons learned from past failures is essential for making informed investment decisions in this rapidly evolving space.

Hidden Secrets of Successful DAO Investments

One of the biggest "secrets" to successful DAO investment is understanding the underlying community. A strong, active, and engaged community is a vital indicator of a DAO's health and potential. Look beyond the hype and examine the level of participation in governance proposals, the quality of discussions in community forums, and the overall sentiment towards the project. Another hidden secret lies in diversification. Don't put all your eggs in one basket. Spread your investments across multiple DAOs with different focus areas and risk profiles. This will help mitigate your overall risk and increase your chances of finding successful projects.

Furthermore, pay close attention to the DAO's treasury management. A well-managed treasury is essential for long-term sustainability and growth. Look for DAOs that have clear spending guidelines, transparent reporting, and a responsible approach to managing their assets. Finally, don't underestimate the importance of staying informed. The DAO landscape is constantly evolving, so it's crucial to stay up-to-date on the latest trends, regulations, and security threats. Follow industry news, participate in online communities, and learn from experienced DAO investors. By uncovering these hidden secrets and applying them to your investment strategy, you can significantly increase your chances of success in the world of DAO investing.

Recommendations for DAO Investment Opportunities

My top recommendation for navigating DAO investment opportunities is to prioritize education. Before investing any capital, dedicate time to understanding the fundamentals of DAOs, including their governance structures, tokenomics, and the underlying technology. Explore resources like online courses, industry reports, and community forums to gain a solid foundation of knowledge. Another key recommendation is to start small. Don't rush into investing large sums of money in DAOs. Begin with smaller investments in projects that you understand well and gradually increase your exposure as you gain more experience and confidence.

Furthermore, I strongly recommend conducting thorough due diligence on any DAO you're considering investing in. This includes researching the team behind the project, analyzing their track record, and assessing the security of their smart contracts. Pay close attention to the DAO's governance model and the level of community participation. A healthy and engaged community is a strong indicator of a DAO's long-term potential. Finally, remember that DAO investing is still a relatively new and evolving space. Be prepared for volatility and uncertainty, and always invest with a long-term perspective. Stay patient, stay informed, and be prepared to adapt your strategy as the landscape changes.

Deeper Dive into DAO Governance and Tokenomics

DAO governance refers to the mechanisms by which decisions are made within a Decentralized Autonomous Organization. Unlike traditional organizations with hierarchical management, DAOs rely on token holders to collectively govern the project through voting. Tokenomics, on the other hand, encompasses the economic incentives and mechanisms that drive the DAO's ecosystem, including the distribution, supply, and utility of its native token.

Effective DAO governance is crucial for ensuring the long-term success and sustainability of a project. A well-designed governance model should be transparent, inclusive, and resistant to manipulation. It should allow token holders to propose and vote on key decisions, such as protocol upgrades, treasury management, and the allocation of resources. Tokenomics plays a vital role in aligning the incentives of various stakeholders within the DAO, including token holders, developers, and community members. A well-designed tokenomic model can incentivize participation, reward contributions, and create a sustainable ecosystem that benefits all participants. The interplay between governance and tokenomics is essential for creating a healthy and thriving DAO. By understanding these concepts and carefully evaluating the governance and tokenomic models of different DAOs, investors can make more informed decisions and increase their chances of success. Consider factors like the voting power distribution, the quorum requirements for proposals, and the mechanisms for resolving disputes.

Tips for Successfully Navigating DAO Investments

One of the most crucial tips for navigating DAO investments is to understand the risks involved. DAO investments are often tied to volatile crypto assets, and the regulatory landscape is still evolving. Smart contract vulnerabilities and the potential for governance manipulation are also factors to consider. Therefore, thorough research and risk assessment are paramount before diving into any DAO investment opportunity. Another important tip is to diversify your portfolio. Don't put all your eggs in one basket. Spread your investments across multiple DAOs with different focus areas and risk profiles. This will help mitigate your overall risk and increase your chances of finding successful projects.

Furthermore, stay active in the DAO community. Participate in governance discussions, contribute to the project, and build relationships with other members. This will give you valuable insights into the DAO's inner workings and help you make more informed investment decisions. Also, be patient and have a long-term perspective. DAO investments are not a get-rich-quick scheme. It takes time for projects to develop and mature, so be prepared to hold your tokens for the long haul. Finally, stay informed about the latest developments in the DAO space. Follow industry news, attend conferences, and connect with other investors to stay up-to-date on the latest trends and opportunities.

Understanding the Legal and Regulatory Landscape of DAOs

The legal and regulatory landscape surrounding DAOs is still evolving, creating both opportunities and challenges for investors. Currently, there's no single, globally recognized legal framework for DAOs, which means their legal status can vary significantly depending on the jurisdiction. Some countries are actively exploring ways to regulate DAOs, while others have adopted a more hands-off approach.

One of the key legal challenges facing DAOs is determining their liability. In traditional organizations, liability typically rests with the directors or shareholders. However, in DAOs, liability can be more ambiguous, as decision-making is distributed among token holders. Another regulatory concern is the potential for DAOs to be used for illicit activities, such as money laundering or securities fraud. Regulators are actively exploring ways to address these concerns without stifling innovation. As an investor, it's crucial to be aware of the legal and regulatory risks associated with DAOs. This includes understanding the legal status of the DAO in your jurisdiction and the potential liabilities that you may face as a token holder. Stay informed about the latest regulatory developments and seek legal advice if needed. As the regulatory landscape evolves, DAOs will need to adapt and comply with new rules and regulations to ensure their long-term viability.

Fun Facts About DAO Investment Opportunities

Did you know that the first DAO, aptly named "The DAO," raised over $150 million in Ether in 2016? While it ultimately failed due to a security breach, it demonstrated the immense potential of DAOs for fundraising and community-driven governance. Another fun fact is that some DAOs are now managing real-world assets, such as real estate and art collections. By tokenizing these assets, DAOs are making them more accessible to a wider range of investors.

Furthermore, some DAOs are experimenting with novel governance mechanisms, such as quadratic voting, which allows individuals to express the intensity of their preferences rather than simply casting a yes or no vote. This can lead to more nuanced and representative decision-making. Also, DAOs are not limited to the crypto space. We're seeing the emergence of DAOs in various industries, including healthcare, education, and social impact. These DAOs are leveraging the power of decentralized governance to address real-world problems and create positive change. Finally, the DAO landscape is constantly evolving, with new projects and innovations emerging all the time. It's an exciting and dynamic space with the potential to transform the way organizations are governed and managed.

How to Evaluate DAO Investment Opportunities

Evaluating DAO investment opportunities requires a multi-faceted approach, considering both technical and fundamental factors. Start by thoroughly researching the DAO's team and their track record. Look for experienced individuals with a strong understanding of blockchain technology, governance, and the specific industry the DAO operates in. Next, analyze the DAO's governance model. Is it transparent, inclusive, and resistant to manipulation? Does it allow token holders to propose and vote on key decisions? A well-designed governance model is crucial for ensuring the long-term success of the DAO.

Then, examine the DAO's tokenomics. What is the total supply of tokens? How are tokens distributed? What are the incentives for holding and using tokens? A sustainable tokenomic model should align the incentives of various stakeholders and reward participation. Also, assess the DAO's community. Is it active, engaged, and supportive? A strong community is a vital indicator of a DAO's health and potential. Finally, consider the DAO's business model and its potential for generating revenue. Does it solve a real-world problem or offer a unique value proposition? A sustainable business model is essential for ensuring the long-term viability of the DAO.

What if DAO Investment Opportunities Fail?

It's important to acknowledge that DAO investment opportunities, like any investment, come with the risk of failure. Understanding the potential causes of failure and how to mitigate those risks is crucial for responsible investing. One potential cause of failure is smart contract vulnerabilities. A flaw in the DAO's code could be exploited by hackers, leading to the loss of funds. Another risk is governance manipulation. A small group of token holders could collude to control the DAO and make decisions that benefit themselves at the expense of other members.

Furthermore, the DAO could fail due to a lack of community participation. If token holders are not actively engaged in governance, the DAO could become stagnant and ineffective. Also, the DAO could fail due to regulatory uncertainty. Changes in regulations could make it difficult or impossible for the DAO to operate. So, what happens if a DAO investment fails? In some cases, token holders may lose all of their investment. In other cases, they may be able to recover some of their funds through legal action or through the DAO's insurance policies. To mitigate the risk of failure, it's crucial to diversify your portfolio, conduct thorough due diligence, and stay informed about the latest developments in the DAO space.

Top DAO Investment Opportunities in 2025: A Listicle

Here's a list of some promising DAO investment opportunities to watch out for in 2025:

1.De Fi Protocol DAOs: These DAOs govern decentralized finance protocols, such as lending platforms, decentralized exchanges, and yield aggregators. Investing in these DAOs can provide exposure to the growth of the De Fi ecosystem.

2.NFT Collection DAOs: These DAOs pool resources to acquire valuable NFTs and manage digital art collections. Investing in these DAOs can provide exposure to the growing NFT market.

3.Venture Capital DAOs: These DAOs invest in early-stage crypto projects and startups. Investing in these DAOs can provide exposure to the next generation of blockchain innovation.

4.Social Impact DAOs: These DAOs use decentralized governance to address social and environmental problems. Investing in these DAOs can provide a way to support positive change.

5.Metaverse DAOs: These DAOs develop and govern virtual worlds and metaverse platforms. Investing in these DAOs can provide exposure to the growing metaverse ecosystem.

Remember to conduct thorough research and due diligence before investing in any DAO. This list is not exhaustive, and new DAO investment opportunities are emerging all the time.

Question and Answer

Question: What are the biggest risks associated with DAO investments?

Answer: The biggest risks include smart contract vulnerabilities, governance manipulation, regulatory uncertainty, and the potential for community apathy.

Question: How can I diversify my DAO investment portfolio?

Answer: You can diversify by investing in DAOs with different focus areas, such as De Fi, NFTs, venture capital, and social impact.

Question: What is the role of tokenomics in DAO governance?

Answer: Tokenomics provides the economic incentives that drive the DAO's ecosystem, aligning the interests of various stakeholders.

Question: How can I stay informed about the latest developments in the DAO space?

Answer: Follow industry news, attend conferences, participate in online communities, and connect with experienced DAO investors.

Conclusion of DAO Investment Opportunities: Best Projects 2025

The world of DAO investment presents a fascinating frontier, ripe with potential but also demanding careful consideration. While risks exist, the opportunities for participating in community-driven innovation and shaping the future of finance are undeniable. By prioritizing education, conducting thorough due diligence, and staying informed about the evolving landscape, you can confidently navigate the best DAO investment opportunities in 2025 and beyond.

Post a Comment