Crypto Swing Trading Guide: Master the 7-Day to 30-Day Strategy for Maximum Profits

Imagine making consistent profits trading crypto, without being glued to your screen 24/7. Sounds like a dream, right? Well, it's not just a dream; it's the potential of swing trading, a strategy that allows you to capture gains from short-term price swings in the crypto market.

Many people dabble in crypto trading, but struggle to find a consistent strategy that fits their lifestyle. Day trading can be exhausting, and long-term holding can be nerve-wracking in a volatile market. Finding the sweet spot – a strategy that offers decent returns without requiring constant monitoring – seems like an impossible task.

This guide aims to equip you with the knowledge and tools necessary to master swing trading in the crypto market, specifically focusing on strategies that work within a 7-day to 30-day timeframe. We'll explore technical analysis, risk management, and specific techniques to identify profitable opportunities and maximize your gains.

In this guide, we'll delve into the world of crypto swing trading, exploring effective strategies for capturing profits within a 7-day to 30-day timeframe. We'll cover essential technical analysis techniques, risk management principles, and practical tips to help you navigate the volatile crypto market successfully. Get ready to learn how to identify trends, set stop-loss orders, and optimize your trading strategy for maximum returns in the exciting world of crypto swing trading.

Understanding Crypto Swing Trading

Swing trading in the crypto world is all about capturing profits from price "swings" – short-term fluctuations that last a few days to a few weeks. It's not about becoming a millionaire overnight, but about consistently making smaller gains that add up over time. My first experience with swing trading was a bit of a rollercoaster. I jumped in without a solid plan, relying more on gut feeling than actual analysis. Predictably, I lost some money. It was a valuable lesson, though. It taught me the importance of having a well-defined strategy, setting stop-loss orders, and sticking to a trading plan. After that initial stumble, I dedicated time to learning technical analysis, understanding chart patterns, and developing a risk management strategy. Slowly but surely, I started seeing consistent profits. One key thing I learned was to never let emotions dictate my trades. Fear and greed can be powerful enemies in the trading world. Swing trading is about identifying an upward or downward trend and then capitalizing on it, but the most effective strategy is to make your decision based on research and analysis, without any emotion.

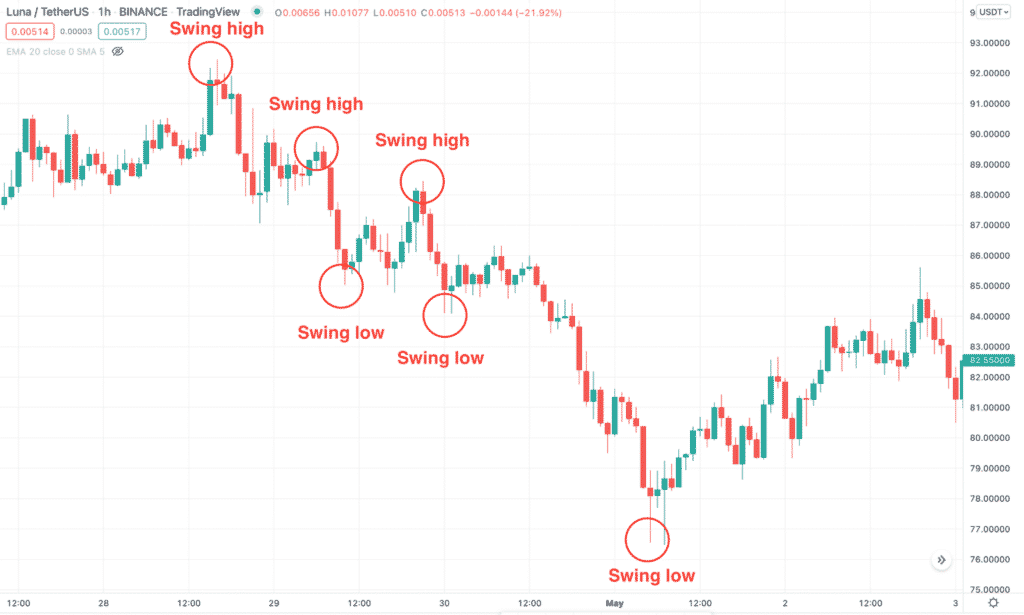

Essential Technical Analysis for Crypto Swing Trading

Technical analysis is the backbone of successful swing trading. It involves studying historical price charts and using indicators to identify potential trading opportunities. It's like being a detective, looking for clues in the price action to predict future movements. There are lots of tools that are available for trading, such as charting tools, historical data, and trading indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracements. Moving averages help smooth out price data, making it easier to identify trends. The RSI indicates whether an asset is overbought or oversold, signaling potential reversals. Fibonacci retracements can help identify potential support and resistance levels. Learning to interpret these indicators can significantly improve your trading accuracy. A common mistake is relying on a single indicator. It's best to use a combination of indicators and chart patterns to confirm your trading signals. Always remember that technical analysis is not foolproof, but it provides valuable insights into market behavior.

The History and Myths of Crypto Swing Trading

The roots of swing trading extend back to the early days of stock market speculation, long before the advent of cryptocurrencies. Traders have always sought to profit from short-term price fluctuations. As crypto emerged, swing trading quickly adapted, offering opportunities in this highly volatile market. There are many myths surrounding the concept of swing trading, one of the biggest myths being that swing trading is a "get rich quick" scheme. While it can be profitable, it requires skill, discipline, and risk management. There's the myth that swing trading is only for experts. While experience helps, anyone can learn the basics and start with a small amount of capital. Another common myth is that you need to constantly monitor the market. While it's important to keep an eye on your trades, you don't need to be glued to your screen 24/7. This strategy can be done by taking 10 to 30 minutes each day, and then making a trading decision. The rise of algorithmic trading and AI is changing the landscape of swing trading. These technologies can automate the analysis and execution of trades, potentially offering an edge to those who use them. Swing trading is not just about making money; it's about learning and adapting to the ever-changing market.

Hidden Secrets of Crypto Swing Trading

Successful swing trading isn't just about knowing technical indicators; it's about understanding market psychology and developing a winning mindset. One key secret is to learn to control your emotions. Fear and greed can lead to impulsive decisions that can cost you money. Another secret is to focus on the process, not just the outcome. If you have a solid strategy and follow it consistently, the profits will eventually come. Don't get discouraged by losses. Every trader experiences losing trades. The key is to learn from your mistakes and keep improving. Position sizing is crucial. Don't risk too much capital on any single trade. A good rule of thumb is to risk no more than 1-2% of your total capital per trade. Market sentiment plays a big role in price movements. Pay attention to news, social media, and other sources of information to get a sense of the overall market mood. Many successful traders keep a trading journal to track their trades, analyze their performance, and identify patterns. This can be a valuable tool for improving your trading skills. Remember that continuous learning and adaptation are essential for long-term success in crypto swing trading.

Recommendations for Crypto Swing Trading

If you're serious about mastering crypto swing trading, there are several resources and tools that can help you along the way. Find the tools that match with your trading skill, such as trading platforms, charting software, and educational resources. Choose a reputable exchange with good security and low fees. Trading View is a popular platform with advanced charting tools and a wide range of indicators. There are many online courses, books, and websites that can teach you about technical analysis and swing trading strategies. Join online communities and forums where you can interact with other traders, share ideas, and learn from their experiences. However, avoid signal groups that promise guaranteed profits. Do your own research and develop your own trading strategy. Paper trading is a great way to practice your strategies without risking real money. Most exchanges and trading platforms offer paper trading accounts. Backtesting involves testing your trading strategy on historical data to see how it would have performed in the past. This can help you identify potential weaknesses and refine your approach. Remember, there is no "magic bullet" in trading. It takes time, effort, and dedication to become a successful swing trader.

Setting Realistic Expectations

It's crucial to approach crypto swing trading with realistic expectations. Don't expect to get rich quick. Swing trading is a marathon, not a sprint. While it is possible to generate substantial profits through swing trading, it's important to understand that it also carries significant risks. The crypto market is highly volatile, and prices can fluctuate dramatically in short periods of time. The amount of capital you have available will directly impact your potential profits. Smaller accounts will naturally generate smaller returns. Consider starting with a small amount of capital and gradually increasing your position size as you gain experience and confidence. Develop a trading plan that outlines your goals, strategies, risk tolerance, and money management rules. This will help you stay disciplined and avoid impulsive decisions. Keep learning and adapting to the ever-changing market conditions. What works today may not work tomorrow. Stay informed about new technologies, regulations, and market trends. Be prepared to adjust your strategies as needed.

Tips for Successful Crypto Swing Trading

Successful crypto swing trading requires a combination of knowledge, discipline, and effective risk management. One of the most important tips is to always use stop-loss orders. This will limit your potential losses if the market moves against you. Set your stop-loss orders at a level that you're comfortable with, based on your risk tolerance and the volatility of the asset. Don't let your emotions dictate your trades. Fear and greed can cloud your judgment and lead to mistakes. Stick to your trading plan and avoid making impulsive decisions. Be patient and wait for the right opportunities to present themselves. Don't force trades. It's better to miss a few opportunities than to lose money on bad trades. Keep a close eye on market news and events that could impact crypto prices. This will help you anticipate potential price movements and adjust your strategy accordingly. Review your trades regularly to identify your strengths and weaknesses. Learn from your mistakes and keep improving your trading skills. Diversify your portfolio to reduce risk. Don't put all your eggs in one basket. Consider trading a variety of different cryptocurrencies. This helps in the long run, and also makes the trading process fun.

Understanding Market Sentiment

Market sentiment refers to the overall attitude or feeling of investors towards a particular asset or market. It can be bullish (positive), bearish (negative), or neutral. Understanding market sentiment can give you an edge in your swing trading strategy. There are several ways to gauge market sentiment. News headlines, social media, and online forums can provide insights into the overall mood of the market. Sentiment indicators, such as the Fear & Greed Index, can quantify market sentiment and provide a visual representation of investor emotions. During periods of extreme fear, prices may be driven down by panic selling, creating potential buying opportunities for contrarian investors. Conversely, during periods of extreme greed, prices may be inflated, creating potential selling opportunities. Market sentiment is not always rational. Emotions can drive prices away from their fundamental value, creating opportunities for skilled traders. Be wary of herd mentality. Don't blindly follow the crowd. Do your own research and make your own decisions. Sentiment can change quickly, so it's important to stay flexible and adapt your strategy as needed. Consider using market sentiment as a filter for your trading signals. Only take trades that align with the overall market sentiment.

Fun Facts About Crypto Swing Trading

Did you know that the first ever cryptocurrency transaction was for pizza? In 2010, Laszlo Hanyecz paid 10,000 Bitcoins for two pizzas, which at today's prices would be worth hundreds of millions of dollars! The volatility of the crypto market is legendary. Prices can swing wildly in a matter of hours, creating both opportunities and risks for swing traders. Bitcoin, the first cryptocurrency, was created by someone (or a group of people) using the pseudonym Satoshi Nakamoto. To this day, nobody knows who Satoshi Nakamoto is. There are thousands of different cryptocurrencies in existence, each with its own unique features and use cases. Some cryptocurrencies are designed for specific purposes, such as privacy, decentralized finance (De Fi), or gaming. Crypto swing trading has become increasingly popular over the years, attracting both experienced traders and newcomers to the market. The rise of social media and online trading platforms has made it easier than ever to learn about and participate in crypto trading. Crypto is available 24/7, so there are no breaks. Unlike traditional markets, which have set trading hours, the crypto market never closes. This is important to remember.

How to Manage Risk in Crypto Swing Trading

Risk management is paramount in crypto swing trading due to the market's inherent volatility. Protect your capital by setting stop-loss orders on every trade. This will automatically exit your position if the price moves against you, limiting your potential losses. Never risk more than a small percentage of your trading capital on any single trade. A common rule of thumb is to risk no more than 1-2% of your total capital per trade. Diversify your portfolio by trading a variety of different cryptocurrencies. This will help reduce your overall risk. Use leverage with caution. While leverage can amplify your profits, it can also amplify your losses. Only use leverage if you fully understand the risks involved. Be aware of the potential for scams and hacks in the crypto world. Use strong passwords, enable two-factor authentication, and store your crypto in a secure wallet. Don't invest more money than you can afford to lose. Crypto swing trading can be profitable, but it's also risky. Only invest what you're comfortable losing. Continuously monitor your trades and adjust your risk management strategy as needed. Market conditions can change quickly, so it's important to stay flexible.

What If Your Crypto Swing Trade Goes Wrong?

Even with the best strategies and risk management, losing trades are inevitable in crypto swing trading. The most important thing is to have a plan for how to deal with them. Don't panic. Losing trades are a normal part of trading. Don't let your emotions cloud your judgment. Review the trade to understand what went wrong. Did you misread the market? Did you violate your trading plan? Learning from your mistakes is essential for improving your trading skills. Accept the loss and move on. Don't dwell on it or try to "revenge trade" to make up for it. This can lead to even bigger losses. Take a break if you're feeling stressed or emotional. Sometimes it's best to step away from the market for a while to clear your head. Re-evaluate your trading strategy and risk management rules. Make sure they are still appropriate for the current market conditions. Reduce your position size if you're experiencing a string of losing trades. This will help you protect your capital. Consider seeking advice from a more experienced trader. They may be able to offer insights or identify areas where you can improve. Always trade responsibly and within your means.

Listicle: Top 5 Tips for Crypto Swing Trading Success

To recap, here are five key tips to help you succeed in crypto swing trading:

- Develop a well-defined trading plan: Outline your goals, strategies, risk tolerance, and money management rules.

- Master technical analysis: Learn to read charts, use indicators, and identify potential trading opportunities.

- Manage your risk effectively: Always use stop-loss orders, diversify your portfolio, and use leverage with caution.

- Control your emotions: Don't let fear and greed dictate your trades. Stick to your plan and avoid impulsive decisions.

- Continuously learn and adapt: Stay informed about market news, trends, and technologies, and adjust your strategy as needed. This is the best way to find a technique that works for you.

By following these tips, you can increase your chances of success in the exciting world of crypto swing trading. Good luck!

Question and Answer about Crypto Swing Trading

Q: What is the ideal timeframe for crypto swing trading?

A: Typically, swing trades in crypto last from a few days to a few weeks, often within the 7-day to 30-day range.

Q: How important is technical analysis in crypto swing trading?

A: Technical analysis is crucial. It helps you identify potential entry and exit points based on price patterns, trends, and indicators.

Q: What is the biggest risk in crypto swing trading?

A: Volatility. Crypto prices can fluctuate wildly and unexpectedly, leading to potential losses if risk isn't managed carefully.

Q: What are some essential tools for crypto swing traders?

A: Charting software (like Trading View), crypto exchange platforms, and resources for learning technical analysis.

Conclusion of Crypto Swing Trading Guide: Master the 7-Day to 30-Day Strategy for Maximum Profits

Mastering crypto swing trading requires a blend of knowledge, discipline, and strategic risk management. By understanding technical analysis, setting realistic expectations, and controlling your emotions, you can position yourself for success in this dynamic market. Remember to continuously learn and adapt, always managing risk responsibly. With dedication and the right approach, crypto swing trading can be a rewarding venture.

Post a Comment