Crypto Market Correlation: How Bitcoin Affects Altcoin Prices (Data Analysis)

Ever wonder why your favorite altcoin suddenly nosedives when Bitcoin sneezes? You're not alone. The cryptocurrency market can feel like a wild rollercoaster, and understanding the relationship between Bitcoin and altcoins is crucial for navigating the ride.

Many crypto investors face the frustration of seeing their altcoin investments suffer disproportionately compared to Bitcoin's movements. Deciphering these market dynamics can be overwhelming, leading to missed opportunities and potentially significant losses. It's difficult to predict when to enter or exit altcoin positions based on Bitcoin's price action. The impact of Bitcoin on altcoins isn't always a simple, one-to-one relationship; various factors influence individual altcoin performance.

This article dives into the fascinating world of crypto market correlation, specifically examining how Bitcoin's price movements impact the performance of altcoins. We'll explore data analysis techniques, discuss the underlying reasons for these correlations, and provide insights to help you make more informed investment decisions.

In short, we've covered the Bitcoin/Altcoin relationship. The key takeaways involve analyzing market correlation through data analysis, understanding why Bitcoin often leads the market, and using this knowledge to improve investment strategies in the volatile cryptocurrency space. We looked at the concept of market dominance, sentiment analysis, and specific correlation examples to provide a comprehensive view of this complex interaction. Think of it as a guide to understanding the rhythm of the crypto market and using Bitcoin's beat to your advantage when it comes to altcoins.

Understanding Bitcoin Dominance

Bitcoin dominance refers to the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies. It's a key indicator that can significantly influence altcoin prices. I remember when I first got into crypto, I was so focused on finding the "next Bitcoin" that I completely ignored Bitcoin itself. I bought a bunch of altcoins based on whitepapers and hype, and then watched them all plummet when Bitcoin crashed. That was a painful but valuable lesson in understanding market dominance.

High Bitcoin dominance often indicates a "flight to safety." When investors are uncertain about the market, they tend to move their funds into Bitcoin, the oldest and most established cryptocurrency. This reduces the capital flowing into altcoins, causing their prices to fall. Conversely, when Bitcoin dominance decreases, it suggests that investors are more willing to take risks and invest in altcoins, often leading to altcoin rallies. This can be attributed to factors like increased institutional adoption of Bitcoin, regulatory clarity surrounding Bitcoin, or simply a renewed interest in alternative blockchain technologies and use cases that altcoins offer. Analyzing Bitcoin dominance in conjunction with price charts and other indicators provides a more nuanced understanding of market sentiment and potential altcoin movements. Seasoned investors often use Bitcoin dominance as a gauge for allocating their capital, shifting between Bitcoin and altcoins based on the prevailing market conditions and risk appetite.

Analyzing Correlation Coefficients

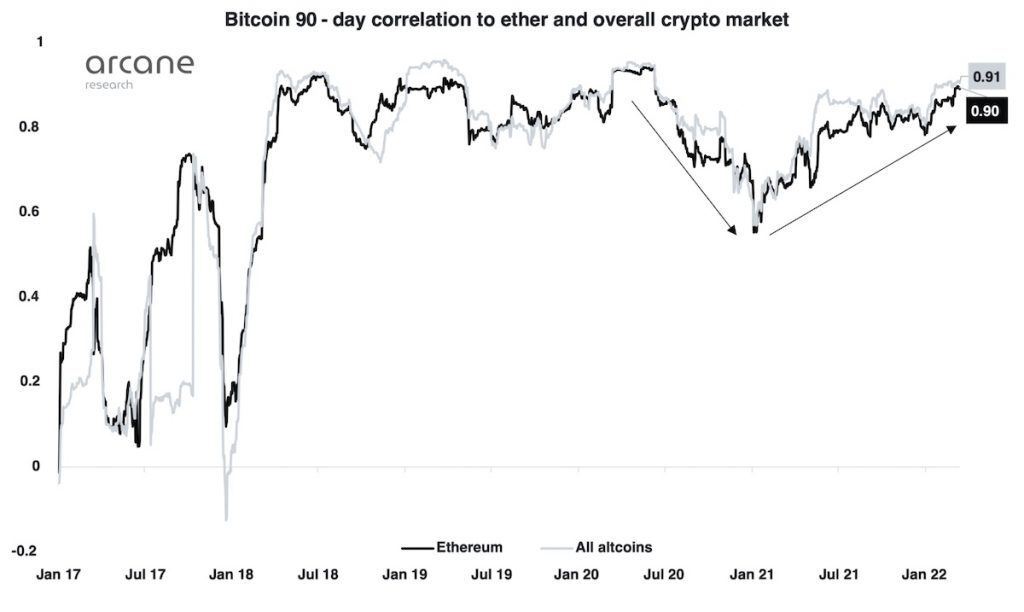

A correlation coefficient is a statistical measure that quantifies the strength and direction of a relationship between two variables. In the context of crypto, it measures how closely the price movements of an altcoin track Bitcoin's price. The coefficient ranges from -1 to +1, where +1 indicates a perfect positive correlation (altcoin price moves in the same direction as Bitcoin), -1 indicates a perfect negative correlation (altcoin price moves in the opposite direction), and 0 indicates no correlation.

Calculating correlation coefficients requires historical price data, which can be obtained from various cryptocurrency exchanges or data providers. Once you have the data, you can use spreadsheet software or statistical programming languages like Python to calculate the coefficient. A strong positive correlation (e.g., above 0.7) suggests that the altcoin is highly dependent on Bitcoin's price movements. A negative correlation, although rare, could indicate that the altcoin serves as a hedge against Bitcoin's volatility. It's crucial to remember that correlation doesn't imply causation. Just because an altcoin's price moves in sync with Bitcoin doesn't necessarily mean that Bitcoin is directly causing the movement. Other factors, such as overall market sentiment, news events, and regulatory announcements, can also play a significant role. Analyzing correlation coefficients over different time periods can reveal changes in the relationship between Bitcoin and altcoins, providing insights into evolving market dynamics. For instance, an altcoin might initially exhibit a strong correlation with Bitcoin but later decouple as its adoption and utility grow.

The History and Myth of Crypto Market Correlation

The idea that Bitcoin dictates the entire crypto market has been around since the early days of altcoins. Initially, this was largely true. Bitcoin was the only game in town, and any new cryptocurrency was essentially trying to piggyback off its success. This created a strong correlation by default. However, the market has matured significantly since then. New technologies, use cases, and institutional investors have entered the space, leading to more complex relationships.

One common myth is that all altcoins are destined to follow Bitcoin's every move. While Bitcoin's influence is undeniable, many altcoins are developing their own ecosystems, communities, and adoption rates, which can lead to periods of decoupling. Another myth is that a high correlation is always a bad thing. In a bull market, a strong positive correlation can amplify gains, as altcoins often outperform Bitcoin. However, in a bear market, the same correlation can lead to steeper losses. It is important to understand the historical context and evolving dynamics of the market. The correlation between Bitcoin and altcoins is not static; it changes over time depending on various factors, including market maturity, technological advancements, and regulatory developments. By recognizing the nuances and challenging the prevailing myths, investors can make more informed decisions and avoid being overly reliant on simplistic assumptions.

Unveiling the Hidden Secrets of Crypto Correlation

One of the best-kept secrets in crypto is that correlation isn't always about direct price movements. It's also about sentiment. When Bitcoin experiences positive news or a price surge, it often creates a wave of optimism across the entire market. This increased confidence can lead to more capital flowing into altcoins, even if those altcoins have no direct connection to Bitcoin.

Conversely, negative news or a price crash for Bitcoin can trigger fear and uncertainty, causing investors to sell off their altcoin holdings. Understanding this psychological element is crucial for predicting market behavior. Another hidden aspect is the impact of specific events on individual altcoins. A major partnership announcement, a successful product launch, or a regulatory approval can significantly impact an altcoin's price, regardless of Bitcoin's movements. These events can create opportunities for investors who are willing to do their research and identify undervalued altcoins with strong fundamentals. Furthermore, analyzing on-chain data, such as transaction volume, active addresses, and network growth, can provide insights into the true demand and adoption of altcoins, helping to identify those that are more likely to decouple from Bitcoin and chart their own course.

Recommendations for Navigating Crypto Correlations

Based on the insights we've discussed, here are some recommendations for navigating the complex world of crypto correlations: Diversify your portfolio. Don't put all your eggs in one basket, even if that basket is Bitcoin. Spreading your investments across a range of altcoins can help mitigate risk.

Do your own research (DYOR). Don't rely solely on the opinions of others. Understand the fundamentals, technology, and use cases of the altcoins you're investing in. Monitor Bitcoin dominance. Keep an eye on the Bitcoin dominance chart to gauge overall market sentiment. Use correlation analysis tools. There are various online tools and resources that can help you calculate correlation coefficients and visualize market relationships. Stay informed. Keep up with the latest news, trends, and developments in the crypto space. By following these recommendations, you can make more informed investment decisions and navigate the volatile crypto market with greater confidence. Remember that crypto investing is inherently risky, and past performance is not indicative of future results. Always invest responsibly and only invest what you can afford to lose. Consider consulting with a financial advisor to get personalized guidance based on your individual circumstances and risk tolerance.

Using Data to Predict Altcoin Performance

Predicting altcoin performance based on Bitcoin's movements isn't an exact science, but data analysis can provide valuable insights. By analyzing historical price data, correlation coefficients, and market sentiment indicators, investors can develop more informed trading strategies. One approach is to identify altcoins that have historically shown a strong positive correlation with Bitcoin during bull markets. These altcoins are likely to outperform Bitcoin during periods of sustained price increases. Another strategy is to look for altcoins that have shown a tendency to decouple from Bitcoin during bear markets. These altcoins might offer some protection against downside risk. Sentiment analysis can also be a powerful tool for predicting altcoin performance. By monitoring social media, news articles, and online forums, investors can gauge the overall sentiment towards specific altcoins. Positive sentiment often leads to increased demand and price appreciation, while negative sentiment can trigger sell-offs.

Furthermore, technical analysis techniques, such as charting patterns and technical indicators, can be used to identify potential entry and exit points for altcoin investments. Combining data analysis with fundamental research and a sound risk management strategy can significantly improve your chances of success in the crypto market. It's important to remember that data analysis is just one piece of the puzzle. The crypto market is constantly evolving, and no single indicator or strategy can guarantee profits. However, by leveraging data-driven insights, investors can make more informed decisions and increase their odds of achieving their financial goals.

Tips for Trading Altcoins Based on Bitcoin's Price Action

Trading altcoins based on Bitcoin's price action can be a profitable strategy, but it requires discipline and a clear understanding of market dynamics. One of the most important tips is to set realistic expectations. Altcoins are generally more volatile than Bitcoin, so you should be prepared for larger price swings. Another tip is to use stop-loss orders to limit your losses. A stop-loss order is an instruction to your broker to automatically sell your altcoin if its price falls below a certain level.

This can help protect you from unexpected crashes. It's also crucial to manage your risk carefully. Don't invest more than you can afford to lose. Consider using a position sizing calculator to determine the appropriate amount of capital to allocate to each trade. Diversify your portfolio across multiple altcoins to reduce your overall risk. Pay attention to Bitcoin's dominance and overall market sentiment. If Bitcoin dominance is increasing and market sentiment is negative, it's generally best to avoid trading altcoins. Conversely, if Bitcoin dominance is decreasing and market sentiment is positive, it might be a good time to consider buying altcoins. Finally, remember that trading is a marathon, not a sprint. Don't get discouraged by short-term losses. Stick to your strategy, manage your risk, and stay informed about market developments. Over time, you can build a profitable trading portfolio.

Long-Term vs. Short-Term Correlation

The correlation between Bitcoin and altcoins can vary significantly depending on the time frame being considered. In the short term (e.g., daily or weekly), the correlation is often stronger, as altcoins tend to react quickly to Bitcoin's price movements. However, in the long term (e.g., monthly or yearly), the correlation can weaken, as individual altcoins develop their own unique narratives and adoption rates. For short-term traders, it's crucial to pay close attention to Bitcoin's price action and overall market sentiment. Technical analysis techniques can be particularly useful for identifying short-term trading opportunities. Long-term investors, on the other hand, should focus more on the fundamentals of individual altcoins, such as their technology, use cases, and community support. These factors are more likely to drive long-term price appreciation than short-term market fluctuations.

It's also important to consider the maturity of the altcoin. Newer altcoins are often more highly correlated with Bitcoin, as they lack a proven track record and established user base. More established altcoins, with larger market capitalizations and wider adoption, are more likely to decouple from Bitcoin over time. By understanding the difference between short-term and long-term correlation, investors can tailor their trading strategies to their individual risk tolerance and investment goals. Short-term traders might focus on exploiting short-term price fluctuations, while long-term investors might focus on building a portfolio of fundamentally strong altcoins that are likely to outperform Bitcoin in the long run.

Fun Facts About Crypto Market Correlation

Did you know that some analysts use the "Altcoin Season Index" to predict when altcoins are likely to outperform Bitcoin? This index tracks the performance of the top 50 altcoins relative to Bitcoin and signals when altcoins are in a "season" of outperformance. Another fun fact is that certain altcoins, particularly those in the De Fi space, sometimes exhibit an inverse correlation with Bitcoin during periods of market turmoil. This is because investors often flock to De Fi protocols as a safe haven when traditional markets are crashing. It's also interesting to note that the correlation between Bitcoin and altcoins can vary depending on the geographical region. For example, altcoins might be more popular in certain countries than others, leading to different correlation patterns. Furthermore, social media sentiment can have a significant impact on crypto correlations. A viral tweet or a popular You Tube video can quickly shift market sentiment and cause altcoins to either rally or crash, regardless of Bitcoin's movements.

Another lesser-known fact is that some institutional investors use sophisticated algorithms to exploit correlation discrepancies between Bitcoin and altcoins. These algorithms can identify opportunities to profit from short-term price differences and contribute to market volatility. Understanding these fun facts can provide a more nuanced perspective on crypto market correlation and help investors to better anticipate market movements. While correlation analysis can be a valuable tool, it's important to remember that the crypto market is constantly evolving and no single indicator can predict the future with certainty. Staying informed, diversifying your portfolio, and managing your risk are essential for long-term success in the crypto space.

How to Profit from Crypto Market Correlation

Profiting from crypto market correlation involves a combination of data analysis, strategic thinking, and risk management. One approach is to identify altcoins that have historically shown a strong positive correlation with Bitcoin during bull markets and invest in them when Bitcoin is trending upwards. Another strategy is to look for altcoins that have the potential to decouple from Bitcoin due to unique technological advancements or strong community support. Investing in these altcoins before they decouple can lead to significant gains. Diversifying your portfolio across a range of altcoins with different correlation characteristics can help mitigate risk. You can also use hedging strategies to protect your investments from downside risk. For example, you can short Bitcoin while holding a portfolio of altcoins to offset potential losses during a market downturn. Furthermore, technical analysis can be used to identify potential entry and exit points for altcoin trades based on Bitcoin's price action. For example, you can buy altcoins when Bitcoin breaks out above a key resistance level and sell them when Bitcoin breaks down below a key support level.

It's crucial to stay informed about market developments and regulatory announcements, as these can significantly impact crypto correlations. By combining data analysis, strategic thinking, and risk management, you can increase your chances of profiting from crypto market correlation. Remember that crypto investing is inherently risky, and past performance is not indicative of future results. Always invest responsibly and only invest what you can afford to lose. Consider consulting with a financial advisor to get personalized guidance based on your individual circumstances and risk tolerance.

What If Bitcoin Loses Its Dominance?

The question of what happens if Bitcoin loses its dominance is a crucial one for crypto investors. If Bitcoin's dominance were to decline significantly, it could have a profound impact on altcoin prices and the overall market landscape. One possible scenario is that altcoins would become less correlated with Bitcoin and more driven by their own individual fundamentals. This could lead to a more diversified and mature market, with altcoins competing on their own merits rather than simply following Bitcoin's lead. Another possibility is that a new cryptocurrency could emerge as the dominant force in the market. This could be a more technologically advanced cryptocurrency or one that offers superior use cases. In this scenario, altcoins might become correlated with the new dominant cryptocurrency instead of Bitcoin.

If Bitcoin's dominance were to decline gradually, the impact on altcoin prices might be less severe. Altcoins could gradually decouple from Bitcoin over time, as their adoption and utility grow. However, if Bitcoin's dominance were to decline suddenly, it could trigger a market crash, as investors rush to sell off their holdings. It's important to remember that Bitcoin's dominance is not guaranteed. The cryptocurrency market is constantly evolving, and new technologies and use cases could emerge that challenge Bitcoin's position. Investors should be prepared for the possibility that Bitcoin's dominance could decline and adjust their investment strategies accordingly. Diversifying your portfolio, staying informed about market developments, and managing your risk are essential for navigating the ever-changing crypto landscape.

Listicle: Key Factors Affecting Crypto Market Correlation

Here are key factors that influence how Bitcoin affects altcoin prices:

- Bitcoin's Market Dominance: Higher dominance usually means altcoins follow Bitcoin closely.

- Overall Market Sentiment: Positive sentiment boosts both Bitcoin and altcoins; fear hurts them.

- Technological Advancements: Unique tech in an altcoin can help it decouple from Bitcoin.

- Adoption Rates: Wider use of an altcoin makes it less dependent on Bitcoin's price.

- Regulatory News: Regulations can impact altcoins differently, affecting correlation.

- Major Partnerships: Big partnerships for altcoins can boost their value independently.

- Liquidity: Lower liquidity in altcoins makes them more volatile and susceptible to Bitcoin's influence.

- Trading Volume: Higher trading volume indicates stronger interest and potential decoupling.

- Social Media Buzz: Viral trends can temporarily disrupt correlation patterns.

- Economic Events: Global economic events can influence crypto investments, affecting correlations.

These factors highlight the complex interplay of elements that determine how altcoins respond to Bitcoin's movements. Monitoring these aspects can give investors a better understanding of potential shifts in the crypto market and help them make more informed decisions.

Question and Answer

Q: Does a high correlation between Bitcoin and an altcoin always mean the altcoin is a bad investment?

A: Not necessarily. In a bull market, a high positive correlation can mean the altcoin benefits from Bitcoin's upward momentum. However, it also means the altcoin is likely to suffer if Bitcoin drops.

Q: How can I use correlation analysis to improve my trading strategy?

A: You can identify altcoins that tend to outperform Bitcoin during rallies or decouple during downturns. This helps you choose assets that might offer better returns or downside protection.

Q: What are some limitations of using correlation as an investment strategy?

A: Correlation doesn't equal causation. External factors and sudden news can disrupt established patterns. Also, past correlation doesn't guarantee future performance.

Q: Where can I find data to calculate correlation coefficients between Bitcoin and altcoins?

A: Cryptocurrency exchanges like Binance, Coinbase, and Kraken often provide historical price data. Websites like Coin Market Cap and Coin Gecko also offer data and tools for analysis.

Conclusion of Crypto Market Correlation: How Bitcoin Affects Altcoin Prices

Understanding the correlation between Bitcoin and altcoin prices is essential for navigating the crypto market. While Bitcoin's dominance often dictates market trends, individual altcoins can exhibit unique behavior based on their technology, adoption, and market sentiment. By analyzing historical data, monitoring market dynamics, and managing risk effectively, investors can make more informed decisions and potentially profit from the complex interplay between Bitcoin and altcoins.

Post a Comment