Crypto Fear and Greed Index Explained: How to Use Market Sentiment for Trading

Ever felt like the crypto market is an emotional rollercoaster, swinging wildly between euphoric highs and terrifying lows? You're not alone! Figuring out when to buy and sell can feel impossible when your decisions are swayed by fear and greed. What if there was a way to cut through the noise and make more rational investment choices?

Many crypto traders find themselves struggling to navigate the market's unpredictable swings. They get caught up in the hype, buying high when everyone else is, only to panic sell when the market dips. The end result? Missed opportunities and potential losses that could have been avoided.

This is where the Crypto Fear and Greed Index comes in. It's a single number that summarizes the overall sentiment of the crypto market, helping you understand whether investors are feeling fearful or greedy. By understanding this sentiment, you can potentially make more informed trading decisions, buying when fear is high and selling when greed is rampant.

In essence, the Crypto Fear and Greed Index provides a snapshot of market emotions, potentially assisting traders in making calculated moves. It is a tool designed to help investors understand if fear or greed is driving the market, offering a possible edge in timing buys and sells. Let's dive in and explore how you can use it.

Deciphering the Crypto Fear and Greed Index

For years, I traded crypto based purely on gut feeling and the advice of online gurus.I'd see a coin pumping and FOMO (fear of missing out) would kick in, leading me to buy at the peak, only to watch it crash shortly after. Conversely, when the market was down, I'd panic and sell, locking in losses. Sound familiar? I knew there had to be a better way. That's when I stumbled upon the Crypto Fear and Greed Index.

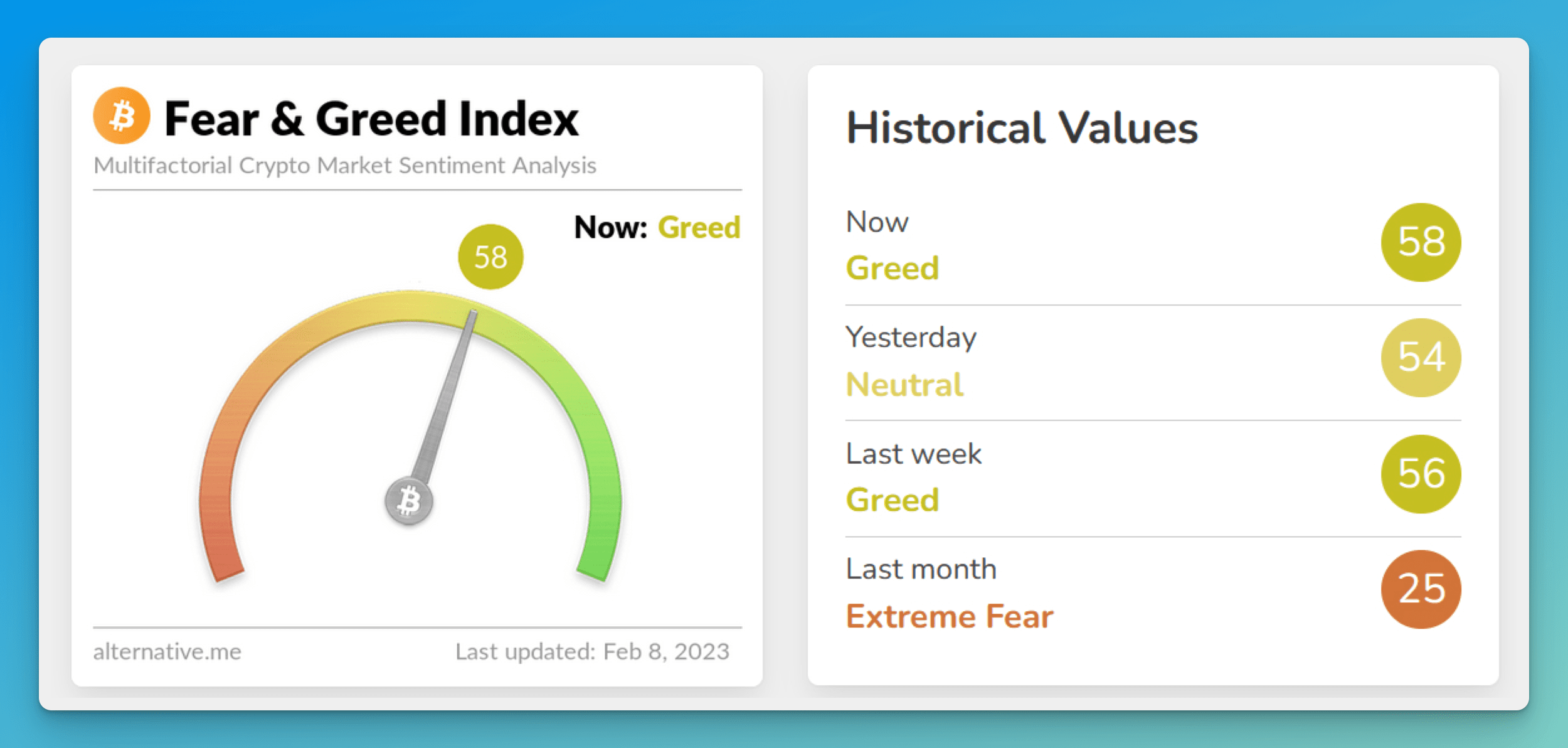

At first, I was skeptical. Could a single number really tell me what the market was thinking? But the more I researched, the more it made sense. The index aggregates data from various sources, like volatility, market momentum, social media, and Google Trends, to provide a comprehensive view of market sentiment. It ranges from 0 to 100, with 0 indicating "Extreme Fear" and 100 indicating "Extreme Greed."

The key is to use it as a contrarian indicator. When the index shows "Extreme Fear," it suggests that investors are overly pessimistic, potentially presenting a buying opportunity. Conversely, when the index indicates "Extreme Greed," it suggests the market is overbought and a correction might be looming. It's not a perfect predictor, of course, but it's a valuable tool in your arsenal. I found that when the index hit extreme fear, that was a good time to start averaging into positions and vice versa when it got to extreme greed. It certainly helped me to make better decisions and not get wrecked by my emotions.

What Exactly is the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index is a tool designed to gauge the prevailing emotions driving the cryptocurrency market. It's not a crystal ball, but rather a sentiment analysis tool that helps to decipher whether fear or greed is dominating investor behavior. Understanding these emotions can be incredibly valuable in making informed trading decisions.

The index operates on a scale from 0 to 100. A score closer to 0 indicates "Extreme Fear," suggesting that investors are overly worried and the market might be oversold. Conversely, a score closer to 100 indicates "Extreme Greed," suggesting that investors are overly optimistic and the market might be overbought. The middle ground represents a more neutral sentiment.

The index is calculated by analyzing a variety of factors, including volatility, market momentum/volume, social media sentiment, dominance, and Google Trends data related to Bitcoin and other cryptocurrencies. Each factor is weighted based on its perceived importance in influencing market sentiment. For example, volatility often plays a significant role, as large price swings tend to amplify fear and greed. By combining these factors, the index provides a single, easily digestible number that represents the overall emotional climate of the crypto market.

The History and Myths Surrounding the Index

The concept of using fear and greed as indicators in financial markets isn't new. Legendary investor Warren Buffett famously advised, "Be fearful when others are greedy, and be greedy when others are fearful." The Crypto Fear and Greed Index is essentially an attempt to quantify this age-old wisdom specifically for the cryptocurrency market.

While the exact origins of the index are somewhat hazy, it gained popularity in the late 2010s as a way to bring some objectivity to the often-chaotic world of crypto trading. It was developed by Alternative.me, which wanted to help people to be less emotional about trading.

One common myth is that the index is a foolproof predictor of market movements. It's important to remember that the index is just one tool among many, and it shouldn't be used in isolation. Market sentiment can change rapidly, and the index is not always accurate. There is no perfect indicator to the market, it is only there to help guide you.

Another myth is that the index is manipulated. While it's possible that large players could try to influence the factors that contribute to the index, it's unlikely that they could do so consistently and effectively. The index is based on a variety of data sources, making it difficult to manipulate in a meaningful way.

Unveiling the Hidden Secrets of the Index

While the Crypto Fear and Greed Index presents itself as a straightforward indicator, there are some nuances and hidden layers that can enhance its usefulness. One key secret is understanding the individual components that make up the index. By analyzing each component, you can gain a deeper understanding of the factors driving market sentiment.

For example, if the index is showing "Fear" primarily due to high volatility, it might suggest a short-term buying opportunity. However, if the "Fear" is driven by negative social media sentiment and declining Google Trends, it could indicate a more sustained downturn. Another hidden secret lies in combining the index with other technical and fundamental analysis tools. The index can be used to confirm or contradict signals generated by other indicators. For instance, if a technical indicator suggests a bullish breakout, but the Fear and Greed Index is showing "Extreme Greed," it might be prudent to exercise caution.

Another important consideration is the timeframe. The index is typically used to gauge short- to medium-term market sentiment. It's less effective for long-term investment decisions. Finally, it's crucial to remember that the index is a reflection of the collective emotions of the market. It doesn't necessarily reflect the underlying fundamentals of individual cryptocurrencies.

Recommendations for Using the Crypto Fear and Greed Index

My top recommendation for using the Crypto Fear and Greed Index is to incorporate it into your existing trading strategy as a confirmation tool. Don't rely on it as your sole indicator. Instead, use it to validate signals generated by other technical or fundamental analysis methods.

Another important recommendation is to consider your own risk tolerance. If you're a conservative investor, you might choose to be more cautious when the index is showing "Extreme Greed," even if other indicators suggest a buying opportunity. Conversely, if you're a more aggressive investor, you might be willing to take on more risk when the index is showing "Extreme Fear."

I also recommend tracking the index over time. By observing how the index behaves in different market conditions, you can gain a better understanding of its predictive power and its limitations. Pay attention to how the index reacts to major news events, regulatory changes, and technological developments.

Finally, remember that the Crypto Fear and Greed Index is just one piece of the puzzle. Successful crypto trading requires a combination of knowledge, discipline, and a healthy dose of skepticism. By combining the index with other tools and techniques, you can increase your chances of making informed and profitable trading decisions. It takes time and effort, so stick to it, it will get better.

Understanding the Components of the Index

Delving deeper, the Crypto Fear and Greed Index isn't just a magic number pulled from thin air. It's a weighted average of several different factors that contribute to overall market sentiment. Understanding these components is crucial for interpreting the index accurately.

Volatility: Measures the current and past volatility of Bitcoin, capturing the level of fear in the market. A high volatility suggests that the markets are in disarray. Market Momentum/Volume: Compares the current market momentum and trading volume to recent averages. High buying volume may indicate greed and vice versa. Social Media: Analyzes social media sentiment, specifically Twitter, to gauge the overall tone of conversations about Bitcoin. Dominance: Measures Bitcoin's dominance in the cryptocurrency market. An increase in Bitcoin dominance may signal that people are leaving altcoins and going back to BTC because it is considered a safe haven. Trends: Analyzes Google Trends data for search terms related to Bitcoin, providing insight into the level of public interest.

Each of these components is assigned a weight based on its perceived impact on market sentiment. By understanding how each component is performing, you can gain a more nuanced understanding of the overall market environment. For example, if the index is showing "Fear" primarily due to high volatility, it might suggest a short-term buying opportunity. However, if the "Fear" is driven by negative social media sentiment and declining Google Trends, it could indicate a more sustained downturn.

Tips for Using the Crypto Fear and Greed Index Effectively

To maximize the effectiveness of the Crypto Fear and Greed Index, consider these practical tips. First, use it as a contrarian indicator. As the saying goes, "Buy when there's blood in the streets." When the index shows "Extreme Fear," it suggests that investors are overly pessimistic, potentially presenting a buying opportunity. Conversely, when the index indicates "Extreme Greed," it suggests the market is overbought and a correction might be looming.

Second, don't rely solely on the index. Use it in conjunction with other technical and fundamental analysis tools. The index can be used to confirm or contradict signals generated by other indicators. For instance, if a technical indicator suggests a bullish breakout, but the Fear and Greed Index is showing "Extreme Greed," it might be prudent to exercise caution. Third, consider your own risk tolerance. If you're a conservative investor, you might choose to be more cautious when the index is showing "Extreme Greed," even if other indicators suggest a buying opportunity. Conversely, if you're a more aggressive investor, you might be willing to take on more risk when the index is showing "Extreme Fear."

Fourth, track the index over time. By observing how the index behaves in different market conditions, you can gain a better understanding of its predictive power and its limitations. Finally, remember that the index is a reflection of the collective emotions of the market. It doesn't necessarily reflect the underlying fundamentals of individual cryptocurrencies.

Combining the Index with Other Trading Strategies

The Crypto Fear and Greed Index shines brightest when integrated with other trading strategies. Think of it as a complementary tool, adding an extra layer of insight to your existing methods. For example, if you're a fan of technical analysis, you can use the index to confirm or reject signals generated by chart patterns and indicators. A bullish breakout pattern might seem promising, but if the Fear and Greed Index is flashing "Extreme Greed," it could be a sign of a fakeout.

Similarly, if you're a fundamental analyst, you can use the index to gauge how the market is reacting to news and events. Positive news might be overshadowed by "Extreme Fear," creating a buying opportunity. Conversely, negative news might be amplified by "Extreme Greed," leading to a sell-off. Another effective strategy is to use the index to adjust your position size. When the index is showing "Extreme Fear," you might choose to increase your position size, while when the index is showing "Extreme Greed," you might reduce your position size.

By combining the Crypto Fear and Greed Index with other trading strategies, you can create a more robust and adaptable approach to the cryptocurrency market. The key is to experiment and find what works best for your individual style and risk tolerance. There are many ways to combine tools, so find something that works for you.

Fun Facts About the Crypto Fear and Greed Index

Did you know that the Crypto Fear and Greed Index has been used to predict some major market swings? While it's not always accurate, there have been instances where the index correctly foreshadowed significant price movements. It is important to note that the index is a tool and not a perfect predictor.

Another fun fact is that the index tends to be more volatile during periods of high market uncertainty. For example, during regulatory crackdowns or major hacks, the index often swings wildly between "Extreme Fear" and "Extreme Greed." The index also has a unique way of influencing the crowd; the crowd sometimes can influence the data in the index.

It's also interesting to note that the index is not limited to Bitcoin. While it's primarily focused on Bitcoin sentiment, it can also be used to gauge the overall mood of the cryptocurrency market as a whole. This is because Bitcoin tends to be a leading indicator for other cryptocurrencies. Finally, the index is freely available online. Several websites and apps track the index in real-time, making it easily accessible to anyone interested in using it.

How to Access and Track the Crypto Fear and Greed Index

Accessing and tracking the Crypto Fear and Greed Index is incredibly straightforward. The index is readily available on several websites and apps dedicated to cryptocurrency data and analysis. A simple Google search for "Crypto Fear and Greed Index" will lead you to multiple sources, including Alternative.me, the original creator of the index.

Most websites that track the index provide a real-time display of the current value, along with historical data and charts. This allows you to see how the index has behaved over time and how it correlates with market movements. Some platforms also offer email alerts or mobile notifications that can notify you when the index reaches certain thresholds, such as "Extreme Fear" or "Extreme Greed."

In addition to websites and apps, the index is also often integrated into cryptocurrency trading platforms. This allows you to view the index directly within your trading interface, making it easier to incorporate it into your trading decisions. If you're serious about using the index, it's worth exploring the different options available and finding a platform that suits your needs. Most of the platforms are very user friendly and easy to use, so don't let that stop you.

What If the Crypto Fear and Greed Index is Wrong?

It's crucial to acknowledge that the Crypto Fear and Greed Index isn't infallible. Like any market indicator, it can be wrong. Market sentiment is a complex and ever-changing phenomenon, and the index is simply a snapshot of the prevailing emotions at a given time. There are times when the index might suggest "Extreme Fear," but the market continues to rise. Conversely, there are times when the index might indicate "Extreme Greed," but the market starts to decline.

When the index is wrong, it's important to avoid making rash decisions. Don't blindly follow the index without considering other factors. Instead, use it as a starting point for further analysis. Ask yourself why the index might be wrong. Are there any specific news events or market conditions that might be influencing sentiment in a way that the index isn't capturing?

Remember, the index is just one tool among many. It's not a crystal ball. Successful crypto trading requires a combination of knowledge, discipline, and a healthy dose of skepticism. By using the index in conjunction with other tools and techniques, you can increase your chances of making informed and profitable trading decisions, even when the index is wrong. Keep an open mind and be willing to adapt your strategy as market conditions change.

Listicle: Top 5 Benefits of Using the Crypto Fear and Greed Index

Here's a quick rundown of the key advantages of incorporating the Crypto Fear and Greed Index into your trading toolkit:

- Objective Sentiment Analysis: It provides a quantifiable measure of market sentiment, helping you avoid emotional decision-making.

- Contrarian Indicator: It helps identify potential buying opportunities during periods of "Extreme Fear" and selling opportunities during periods of "Extreme Greed."

- Confirmation Tool: It can be used to confirm or contradict signals generated by other technical and fundamental analysis methods.

- Easy Accessibility: The index is readily available on numerous websites and apps, making it easy to access and track.

- Improved Decision-Making: By understanding market sentiment, you can make more informed and rational trading decisions, potentially increasing your profitability.

By leveraging these benefits, you can gain a significant edge in the competitive world of cryptocurrency trading. The more tools in your tool box, the better.

Question and Answer

Here are some common questions about the Crypto Fear and Greed Index, answered to help you understand it better:

Q: Can the Crypto Fear and Greed Index guarantee profits?

A: No, the index is a tool to help you understand market sentiment. It is not a guarantee of profits, and you can still lose money even if you follow its signals.

Q: How often should I check the Crypto Fear and Greed Index?

A: It depends on your trading style. If you're a day trader, you might check it several times a day. If you're a long-term investor, you might check it once a week or even less frequently.

Q: Is the Crypto Fear and Greed Index applicable to all cryptocurrencies?

A: The index is primarily focused on Bitcoin sentiment, but it can also be used to gauge the overall mood of the cryptocurrency market as a whole.

Q: Where can I find the Crypto Fear and Greed Index?

A: A simple Google search for "Crypto Fear and Greed Index" will lead you to multiple sources, including Alternative.me, the original creator of the index.

Conclusion of Crypto Fear and Greed Index Explained: How to Use Market Sentiment for Trading

The Crypto Fear and Greed Index is not a magic formula for guaranteed riches, but rather a valuable instrument in the crypto trader's toolkit. By understanding and utilizing this index, you can potentially gain a more objective perspective on market sentiment, make more informed trading decisions, and ultimately, improve your chances of success in the volatile world of cryptocurrency. Remember to use it wisely, in conjunction with other analysis methods, and always consider your own risk tolerance.

Post a Comment