Best Crypto Momentum Indicators: RSI MACD & Volume Analysis for Trading

Trying to catch the perfect wave in the crypto market? It's exhilarating, but without the right tools, you might just wipe out. Imagine having a compass that guides you through the choppy waters, helping you spot the best entry and exit points. That's what we're aiming for here – equipping you with the knowledge to navigate the crypto seas with confidence.

Ever feel like you're always one step behind in the crypto world? Prices surge, dips happen unexpectedly, and you're left wondering if you missed a crucial signal. Deciphering market movements can feel like trying to solve a complex puzzle with missing pieces, leading to frustration and missed opportunities.

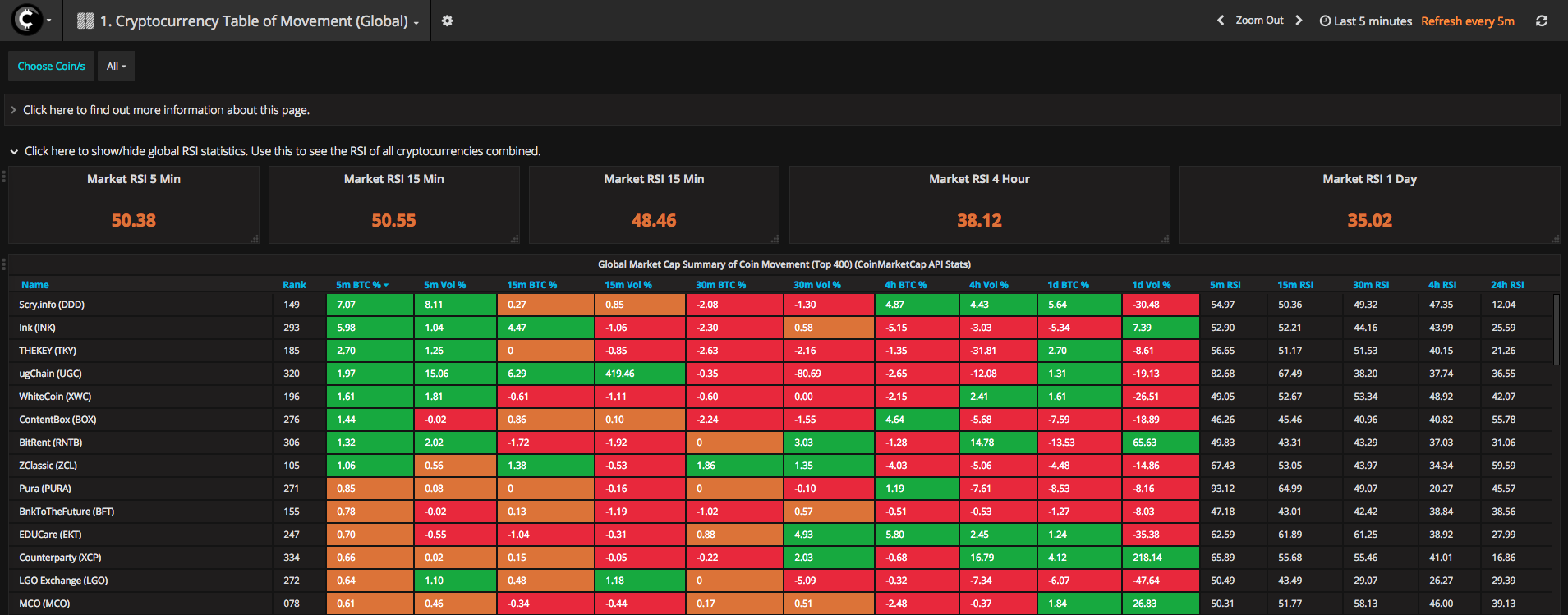

This post is designed to illuminate the path to more informed crypto trading decisions. We'll delve into the power of momentum indicators, specifically the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Volume analysis. By understanding and utilizing these tools, you can gain a better understanding of market trends and potential turning points.

In this guide, we will explore the functionality of RSI, MACD, and volume analysis, showing you how to use them to enhance your crypto trading strategy. We'll look at real-world examples and practical applications so you can use these tools to make smarter choices. Get ready to unlock the secrets of crypto momentum indicators and improve your trading game.

Understanding the Relative Strength Index (RSI)

The RSI, or Relative Strength Index, holds a special place in my trading toolkit. I remember when I first started trading, I was constantly getting faked out by the market. I'd see a coin pumping and jump in, only to watch it crash moments later. A seasoned trader suggested I look into the RSI, saying it could help me avoid those overbought traps. At first, the charts looked intimidating, all those squiggly lines! But after a few tutorials and some paper trading, I started to grasp its potential. The RSI, fundamentally, measures the speed and change of price movements. Its a versatile momentum indicator, ranging from 0 to 100, the RSI signals overbought conditions above 70 and oversold conditions below 30, helping traders identify potential trend reversals. This helped me recognize when assets were overbought and due for a correction, or oversold and potentially ready for a bounce. Now, I wouldn’t dream of making a trade without consulting it, and it has drastically improved my timing in the market.

Decoding the Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence, or MACD, is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It’s calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A nine-day EMA of the MACD, called the "signal line," is then plotted on top of the MACD, functioning as a trigger for buy and sell signals. The MACD is invaluable because it can indicate changes in the strength, direction, momentum, and duration of a trend in a stock's price. When the MACD line crosses above the signal line, it's a bullish signal, suggesting that the price may increase. Conversely, when the MACD line crosses below the signal line, it's a bearish signal, suggesting that the price may decrease. Traders also look for divergences between the MACD and the price action of the asset; for example, if the price is making new highs, but the MACD is not, it could signal a weakening trend. Moreover, the MACD histogram visualizes the difference between the MACD line and the signal line, further clarifying momentum shifts and potential trading opportunities.

The History and Myths of Volume Analysis

Volume analysis has a rich history, predating many modern technical indicators. Legend has it that seasoned traders in the late 19th century, lacking sophisticated charting software, relied heavily on volume to gauge market sentiment. They would scrutinize newspaper stock tables, paying close attention to the number of shares traded alongside price movements, believing volume held the key to unlocking market secrets. One common myth is that high volume always confirms a trend. While increased volume often accompanies strong price movements, it's crucial to analyze it in context. For instance, high volume during a downtrend may indicate panic selling rather than the beginning of a new bear market. Conversely, low volume during an uptrend might suggest a lack of conviction, making the trend unsustainable. Another misconception is that volume analysis is only useful for short-term trading. While it's valuable for identifying immediate buying or selling pressure, volume can also reveal long-term trends. Consistent high volume during accumulation phases, for example, can signal strong institutional support for a particular asset, laying the foundation for a sustained bull run. Understanding these historical nuances and dispelling common myths are essential for effectively integrating volume analysis into your trading strategy.

Unveiling the Hidden Secrets of Combining RSI, MACD, and Volume

The real power of these indicators isn’t in using them in isolation, but in their combined application. Think of it as a symphony orchestra; each instrument plays its part, but the magic happens when they harmonize. One secret is to look for confluence. For example, if the RSI is indicating oversold conditions, and the MACD is about to cross bullishly, accompanied by a spike in volume, it's a strong signal that a potential reversal is imminent. Another hidden gem lies in understanding divergence across indicators. If the price is making higher highs, but the RSI is showing lower highs, it could be a sign of weakening momentum and a potential pullback. Similarly, if the MACD is diverging from the price action, it adds another layer of confirmation. Volume plays a crucial role in validating these signals. A bullish divergence accompanied by increasing volume adds weight to the signal, suggesting that buyers are stepping in. Conversely, a bearish divergence with declining volume may indicate a lack of conviction among sellers. By mastering the art of combining these indicators, you can filter out false signals and improve the accuracy of your trading decisions.

Recommendations for Effective Implementation

When it comes to implementing RSI, MACD, and volume analysis into your trading strategy, consider these recommendations. First, always use these indicators in conjunction with other forms of analysis, such as price action and fundamental analysis. Relying solely on indicators can lead to false signals and missed opportunities. Second, tailor the indicator settings to suit your specific trading style and the asset you're trading. For example, shorter timeframes may require different RSI settings than longer-term investments. Third, practice using these indicators in a demo account before risking real capital. This allows you to familiarize yourself with their nuances and fine-tune your strategy without financial risk. Fourth, keep a trading journal to track your trades and analyze the effectiveness of your indicator-based strategies. This helps you identify patterns, learn from your mistakes, and continuously improve your decision-making process. Fifth, stay informed about market news and events that may impact the performance of these indicators. External factors can influence price movements and invalidate even the strongest technical signals. By following these recommendations, you can harness the power of RSI, MACD, and volume analysis to make more informed and profitable trading decisions.

Advanced Strategies for Crypto Trading

Moving beyond the basics, advanced strategies can significantly enhance your crypto trading. One such strategy is combining Fibonacci retracement levels with RSI and MACD signals. Look for confluence where these indicators align with key Fibonacci levels, offering high-probability entry and exit points. For instance, if the price retraces to the 61.8% Fibonacci level, and the RSI is showing oversold conditions while the MACD is about to cross bullishly, it could be an opportune time to enter a long position. Another powerful technique is using volume price analysis (VPA) to confirm the strength of trends identified by RSI and MACD. VPA involves analyzing the relationship between price movements and volume to gauge market sentiment. For example, if the price is making new highs, and volume is increasing, it suggests strong buying pressure and a sustainable uptrend. Conversely, if the price is making new highs, but volume is decreasing, it could be a sign of weakening momentum and a potential reversal. Furthermore, consider incorporating candlestick patterns into your analysis. Certain candlestick patterns, such as bullish engulfing or hammer patterns, can provide additional confirmation of potential trend reversals or continuations. Combining these patterns with RSI, MACD, and volume analysis can increase the accuracy of your trading signals.

Practical Tips for Trading with Momentum Indicators

Trading with momentum indicators requires a disciplined approach. First, set clear entry and exit rules based on the signals generated by the RSI, MACD, and volume analysis. For example, you might decide to enter a long position when the RSI crosses below 30 and the MACD crosses above its signal line, with a stop-loss order placed below a recent swing low. Second, avoid overtrading. Resist the urge to enter every trade that meets your criteria. Instead, focus on high-quality setups that offer a favorable risk-reward ratio. Third, manage your risk effectively. Use position sizing techniques to limit your potential losses on each trade. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. Fourth, be patient and disciplined. Momentum indicators can generate false signals, especially in volatile markets. Wait for confirmation from multiple indicators before entering a trade, and stick to your trading plan. Fifth, continuously monitor your trades and adjust your strategy as needed. Market conditions can change rapidly, so it's important to stay flexible and adapt to new information. By following these practical tips, you can improve your trading performance and increase your chances of success in the crypto market.

Understanding Divergence in More Detail

Divergence is a powerful concept in technical analysis that can provide valuable insights into potential trend reversals. Divergence occurs when the price action of an asset moves in the opposite direction of a momentum indicator, such as the RSI or MACD. There are two main types of divergence: bullish divergence and bearish divergence. Bullish divergence occurs when the price makes lower lows, but the indicator makes higher lows. This suggests that the selling pressure is weakening, and a potential trend reversal to the upside is likely. Bearish divergence occurs when the price makes higher highs, but the indicator makes lower highs. This suggests that the buying pressure is weakening, and a potential trend reversal to the downside is likely. When identifying divergence, it's important to consider the timeframe you're analyzing. Divergence on a longer timeframe, such as a daily or weekly chart, is generally more reliable than divergence on a shorter timeframe, such as an hourly or 15-minute chart. Additionally, look for confirmation from other indicators or price action patterns before acting on a divergence signal. For example, a bullish divergence accompanied by a break above a key resistance level or a bullish candlestick pattern can provide stronger confirmation of a potential trend reversal. Mastering the art of identifying and interpreting divergence can significantly enhance your trading skills and improve your ability to anticipate market movements.

Fun Facts About Crypto Indicators

Did you know that the RSI was developed by J. Welles Wilder Jr., a mechanical engineer who also invented other popular technical indicators like the Average True Range (ATR) and the Parabolic SAR? Wilder originally created the RSI for analyzing commodity markets, but it quickly gained popularity among stock and forex traders as well. Another interesting fact is that the MACD was invented by Gerald Appel in the late 1970s. Appel initially used it to analyze stock market trends, but it has since become a staple in various financial markets, including the crypto market. Volume analysis has been around for centuries, with early traders relying on hand-written records to track the number of shares traded each day. Today, sophisticated charting software makes volume analysis much easier, but the underlying principles remain the same. Some traders believe that volume precedes price, meaning that changes in volume can often foreshadow future price movements. Others believe that price leads volume, arguing that price action is the primary driver of market trends. Regardless of which viewpoint you subscribe to, understanding the relationship between price and volume is essential for effective trading. Moreover, there are different approaches and strategies for using these indicators, tailored by traders for various asset classes. Exploring these adaptations reveals how widely these momentum tools are used across financial markets.

How to Effectively Use RSI, MACD, and Volume

To effectively use RSI, MACD, and volume analysis, start by understanding the individual strengths and weaknesses of each indicator. The RSI is best suited for identifying overbought and oversold conditions, while the MACD is more effective at identifying trend changes and momentum shifts. Volume analysis can help confirm the strength of trends and identify potential reversals. Once you have a solid understanding of each indicator, begin experimenting with different settings and combinations to find what works best for your trading style and the assets you're trading. For example, you might try using a shorter RSI period for short-term trading or a longer MACD period for long-term investing. When analyzing charts, look for confluence between the indicators. For example, if the RSI is showing oversold conditions and the MACD is about to cross bullishly, it could be a strong buy signal. Always confirm your signals with other forms of analysis, such as price action and fundamental analysis. Avoid relying solely on indicators, as they can generate false signals. Finally, practice using these indicators in a demo account before risking real capital. This will allow you to refine your strategy and build confidence in your ability to interpret the signals accurately. Remember, consistency and discipline are key to successful trading with momentum indicators.

What If Momentum Indicators Give Conflicting Signals?

What happens when your indicators disagree? It's a common scenario that can leave traders scratching their heads. If the RSI suggests an overbought condition, while the MACD signals a bullish trend, what do you do? First, don't panic. Conflicting signals are a natural part of trading and don't necessarily invalidate your analysis. Instead, view them as an opportunity to dig deeper and gain a more nuanced understanding of the market. Second, consider the timeframe you're analyzing. Indicators on different timeframes can provide different signals. For example, the RSI on a short-term chart may show overbought conditions, while the MACD on a long-term chart may still indicate a bullish trend. In this case, it's important to prioritize the longer-term trend. Third, look for confirmation from other indicators or price action patterns. If the price is breaking above a key resistance level, it could confirm the bullish signal from the MACD, even if the RSI is overbought. Conversely, if the price is failing to break above resistance, it could suggest that the overbought signal from the RSI is more reliable. Fourth, consider the overall market context. Is the market in a strong uptrend or downtrend? Are there any major news events or economic releases that could impact the price? Understanding the broader market environment can help you interpret conflicting signals and make more informed trading decisions. Ultimately, the key is to use your judgment and experience to weigh the different signals and make a decision that aligns with your risk tolerance and trading goals.

A Listicle of Best Crypto Momentum Indicators

Here's a quick list of the best ways to use crypto momentum indicators, incorporating RSI, MACD, and volume:

- Identify Potential Reversals: Look for overbought/oversold conditions using RSI, confirmed by MACD crossovers and volume spikes.

- Confirm Trend Strength: Use volume to validate trends signaled by MACD; increasing volume during a trend suggests it's sustainable.

- Spot Divergence: Watch for divergence between price and RSI or MACD, signaling possible trend weakness.

- Combine Indicators: Use RSI, MACD, and volume together for a more comprehensive view, reducing false signals.

- Adjust Settings: Fine-tune indicator settings to fit different timeframes and trading styles.

- Use with Price Action: Always combine indicator analysis with price action patterns for confirmation.

- Manage Risk: Set clear entry/exit rules based on indicator signals and always use stop-loss orders.

- Track Your Trades: Keep a trading journal to analyze the effectiveness of your indicator-based strategies.

- Stay Informed: Keep up with market news that could affect indicator performance.

Question and Answer

Q: What are the ideal RSI levels for overbought and oversold conditions in crypto?

A: Generally, an RSI above 70 suggests overbought conditions, while an RSI below 30 indicates oversold conditions. However, these levels can be adjusted based on the specific cryptocurrency and market conditions.

Q: How can I use MACD to identify potential buy and sell signals?

A: Look for bullish crossovers (MACD line crossing above the signal line) as potential buy signals and bearish crossovers (MACD line crossing below the signal line) as potential sell signals.

Q: What does a significant increase in volume indicate when trading crypto?

A: A significant increase in volume often confirms the strength of a price movement. High volume during an uptrend suggests strong buying pressure, while high volume during a downtrend suggests strong selling pressure.

Q: Can I rely solely on these indicators for my crypto trading decisions?

A: No, it's best to use these indicators in conjunction with other forms of analysis, such as price action, chart patterns, and fundamental analysis, to make more informed trading decisions.

Conclusion of Best Crypto Momentum Indicators: RSI MACD & Volume Analysis for Trading

Mastering the RSI, MACD, and volume analysis can significantly improve your crypto trading skills. By learning to interpret these indicators, you can gain a better understanding of market momentum and potential turning points. Remember to use these tools together and in conjunction with other forms of analysis for optimal results. With practice and discipline, you can unlock the power of these indicators and navigate the crypto market with greater confidence.

Post a Comment