Balancer Protocol Tutorial: Automated Portfolio Management & Liquidity Mining

Ever feel like managing your crypto portfolio is a full-time job? Juggling different assets, rebalancing your holdings, and chasing yield can be exhausting and time-consuming. What if there was a way to automate the entire process, earning rewards while letting your portfolio manage itself?

Many investors struggle with the complexities of decentralized finance (De Fi). Understanding how to effectively manage risk, navigate volatile markets, and actively participate in liquidity mining programs can feel overwhelming. It's tough to keep up with the ever-evolving landscape and find reliable information to make informed decisions.

This tutorial aims to demystify Balancer Protocol, showing you how to leverage its powerful features for automated portfolio management and liquidity mining. We'll walk you through the process step-by-step, from setting up your first pool to earning rewards through providing liquidity.

In this comprehensive guide, we'll explore the core concepts of Balancer Protocol, including its unique automated market maker (AMM) functionality, flexible pool structures, and the opportunities for liquidity mining. We'll delve into the details of creating and managing your own Balancer pools, rebalancing your portfolio automatically, and earning BAL tokens by providing liquidity. Get ready to unlock the potential of decentralized portfolio management and passive income generation.

My First Balancer Pool: A Personal Journey

I remember the first time I tried to set up a Balancer pool. I had been dabbling in De Fi for a while, but the concept of weighted pools and automated rebalancing was still a bit abstract. I started with a simple pool consisting of ETH and USDC, thinking I could easily manage the weights and earn some passive income. The initial setup wasn't too difficult, thanks to Balancer's user-friendly interface. However, things got interesting when I started observing the pool's behavior. I quickly realized that simply setting the weights wasn't enough; I needed to understand the underlying mechanisms driving the automated rebalancing. I learned about arbitrage opportunities and how impermanent loss could impact my holdings. There were definitely moments of frustration, like when I saw my pool's value dip due to unexpected market fluctuations. But overall, the experience was incredibly rewarding. I gained a deeper understanding of AMMs and the power of decentralized portfolio management. Now, I'm much more confident in my ability to create and manage complex Balancer pools, optimizing them for both stability and yield. The key takeaway for me was to start small, experiment with different strategies, and continuously learn from the market's feedback. Balancer empowers users to act as their own fund managers, automating complex strategies and capitalizing on market inefficiencies. This decentralized approach fosters financial autonomy and enables users to participate in the growing De Fi ecosystem.

What Exactly is Balancer Protocol?

Balancer Protocol is a decentralized automated market maker (AMM) that allows users to create and manage their own custom liquidity pools. Unlike traditional AMMs that typically use a 50/50 weighting between two assets, Balancer allows you to create pools with any asset allocation you desire, for example 80/20, 60/40, or even more complex combinations. This flexibility opens up a wide range of possibilities for portfolio management and liquidity mining. The core innovation of Balancer lies in its ability to automatically rebalance your portfolio based on pre-defined weights. As the market value of your assets changes, the protocol adjusts the pool's composition to maintain the target allocation. This automated rebalancing helps you maintain your desired risk profile and potentially generate higher returns. Furthermore, Balancer allows users to earn fees by providing liquidity to these pools. When traders swap tokens within a Balancer pool, they pay a small fee, which is distributed to the pool's liquidity providers. This incentivizes users to contribute their assets to the protocol, increasing liquidity and improving the overall trading experience. Balancer's unique features make it a powerful tool for both passive investors and active traders looking to optimize their De Fi strategies. It's a cornerstone of the decentralized finance revolution, enabling users to manage their assets in a transparent, efficient, and non-custodial manner.

The History and Myth of Balancer

The genesis of Balancer Protocol is rooted in the growing need for more flexible and efficient decentralized exchanges. The initial AMMs, while groundbreaking, were often limited in their functionality and asset allocation options. Balancer emerged as a solution, offering a more customizable and powerful platform for liquidity provision and portfolio management. While there isn't a specific "myth" surrounding Balancer, its innovative features have certainly created a buzz within the De Fi community. Some might even consider its ability to automatically rebalance portfolios as a kind of "magic," simplifying complex investment strategies. However, it's important to remember that Balancer is still a technology with inherent risks. Impermanent loss, smart contract vulnerabilities, and market volatility can all impact your returns. The history of Balancer is also intertwined with the rise of liquidity mining. The protocol incentivized users to provide liquidity by distributing BAL tokens, its native governance token. This led to a surge in participation and helped Balancer quickly establish itself as a leading AMM platform. The success of Balancer has also inspired other projects to explore innovative AMM designs and liquidity mining strategies. As the De Fi space continues to evolve, Balancer's legacy will likely be remembered as a pivotal moment in the development of decentralized finance.

Unlocking Balancer's Hidden Secrets

While Balancer Protocol appears straightforward on the surface, there are several hidden secrets that can help you maximize your returns and minimize your risks. One key secret lies in understanding the impact of different pool weights on impermanent loss. Pools with more volatile assets or larger weight discrepancies are generally more susceptible to impermanent loss. Therefore, carefully choosing your pool composition and weights is crucial for mitigating this risk. Another hidden secret is the strategic use of stablecoin pools. Stablecoin pools, with their lower volatility, can provide a more stable source of income for liquidity providers. They are also less prone to impermanent loss, making them a suitable option for risk-averse investors. Furthermore, understanding the dynamics of arbitrage opportunities can significantly enhance your Balancer experience. By monitoring price discrepancies between different exchanges, you can identify opportunities to profit by rebalancing your own pools. This requires a deeper understanding of market dynamics and technical analysis, but it can be a rewarding strategy for active traders. Ultimately, the "hidden secrets" of Balancer lie in continuous learning, experimentation, and a deep understanding of the underlying mechanisms driving the protocol.

Recommendations for Using Balancer

For those new to Balancer Protocol, I highly recommend starting with a small pool consisting of stablecoins. This will allow you to familiarize yourself with the platform's interface and understand the basics of liquidity provision without exposing yourself to significant risk. Once you're comfortable with the fundamentals, you can gradually increase your exposure to more volatile assets and experiment with different pool weights. Before investing in any Balancer pool, it's crucial to thoroughly research the underlying assets and understand their potential risks and rewards. Pay close attention to the pool's trading volume, liquidity, and historical performance. It's also important to regularly monitor your pool's performance and rebalance your holdings as needed. Balancer's automated rebalancing feature can help, but it's still your responsibility to ensure that your portfolio aligns with your risk tolerance and investment goals. Finally, stay informed about the latest developments in the Balancer ecosystem. The protocol is constantly evolving, with new features and upgrades being released regularly. By staying up-to-date, you can take advantage of new opportunities and optimize your Balancer strategies for maximum returns.

Advanced Strategies for Balancer Pools

Delving deeper into Balancer, experienced users can explore advanced strategies to optimize their pool performance and manage risk more effectively. One such strategy involves creating custom pools tailored to specific market conditions. For instance, during periods of high volatility, a pool with a higher weighting towards stablecoins can provide greater stability and mitigate potential losses. Conversely, during bull markets, a pool with a higher weighting towards growth assets can potentially generate higher returns. Another advanced strategy is to actively manage your pool's weights based on market signals. This requires a deep understanding of technical analysis and the ability to identify trends and patterns in asset prices. By dynamically adjusting your pool's weights, you can potentially capitalize on market fluctuations and maximize your profits. Furthermore, advanced users can also leverage Balancer's API to automate their pool management tasks. This can include automatically rebalancing your pool based on pre-defined rules or integrating your Balancer pools with other De Fi protocols. Mastering these advanced strategies requires significant time and effort, but it can be highly rewarding for those who are willing to put in the work.

Tips and Tricks for Balancer Protocol

Navigating Balancer Protocol can be greatly enhanced with a few insider tips and tricks. Firstly, always double-check the pool's contract address before depositing any funds. This helps prevent accidental deposits into malicious or incorrect pools. Secondly, take advantage of Balancer's gas optimization features. By using tools like the "batch swap" functionality, you can significantly reduce your transaction costs, especially when performing multiple swaps at once. Another useful tip is to monitor the pool's "swap fee" setting. Pools with lower swap fees are generally more attractive to traders, which can lead to higher trading volume and increased fee earnings for liquidity providers. However, lower swap fees may also attract more arbitrage activity, which can impact your pool's impermanent loss. Therefore, it's essential to carefully consider the trade-offs before adjusting the swap fee. Lastly, don't be afraid to experiment with different pool configurations and strategies. The best way to learn and optimize your Balancer performance is to actively participate in the ecosystem and continuously adapt to market conditions. Remember to always prioritize security and risk management, and never invest more than you can afford to lose.

Understanding Impermanent Loss in Balancer

Impermanent loss is a key concept to grasp when participating in any AMM, including Balancer. It occurs when the price of the assets in your pool diverge from their initial values. This divergence triggers arbitrage opportunities, which can result in your pool's value decreasing compared to simply holding the assets separately. The magnitude of impermanent loss is directly related to the volatility and price differences of the assets in your pool. Pools with more volatile assets and larger price discrepancies are generally more susceptible to impermanent loss. While impermanent loss can be a concern, it's important to remember that it's not necessarily a permanent loss. If the prices of the assets in your pool revert to their original values, the impermanent loss will disappear. Furthermore, the fees you earn from providing liquidity can often offset the impact of impermanent loss. Understanding the dynamics of impermanent loss is crucial for making informed decisions about which Balancer pools to participate in and how to manage your risk effectively. Tools like impermanent loss calculators can help you estimate the potential impact of price fluctuations on your pool's value.

Fun Facts About Balancer Protocol

Did you know that Balancer allows you to create pools with up to eight different assets? This level of flexibility is unmatched by most other AMMs. Another fun fact is that Balancer's automated rebalancing feature is essentially like having a robot portfolio manager working for you 24/7. It automatically adjusts your asset allocation to maintain your desired risk profile, saving you time and effort. Furthermore, Balancer's BAL token distribution program has distributed millions of dollars worth of tokens to liquidity providers, incentivizing participation and rewarding users for contributing to the ecosystem. Balancer has also been used to create innovative financial products, such as decentralized index funds, which automatically rebalance based on pre-defined criteria. The protocol's flexibility and programmability have opened up a wide range of possibilities for decentralized finance, and we're likely to see even more exciting applications emerge in the future. Balancer is a testament to the power of open-source innovation and the potential of decentralized finance to transform the way we manage our assets.

How to Get Started with Balancer

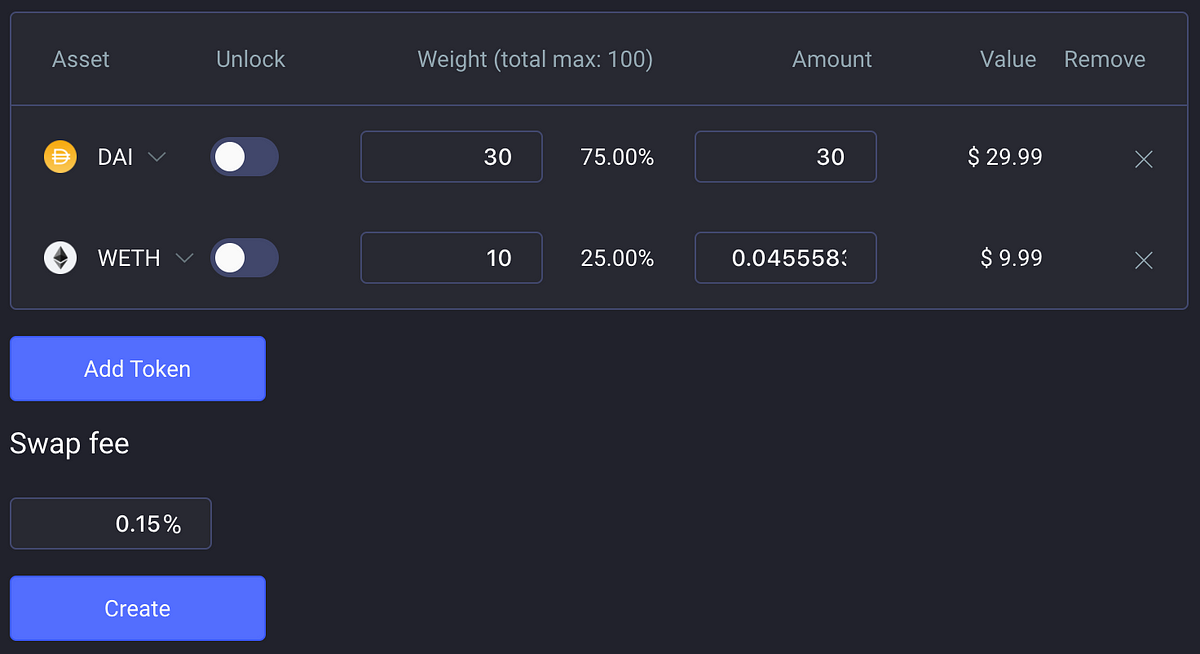

Getting started with Balancer is relatively straightforward, even for beginners. First, you'll need to connect your Web3 wallet, such as Meta Mask, to the Balancer interface. Once connected, you can explore the available pools and choose one that aligns with your investment goals and risk tolerance. Before depositing any funds, make sure to thoroughly research the pool's composition, trading volume, and historical performance. Once you've selected a pool, you can deposit your assets and start earning fees. Alternatively, you can create your own custom pool with your desired asset allocation and weights. This requires a bit more technical knowledge, but it allows you to tailor your pool to your specific needs and potentially generate higher returns. Remember to always prioritize security and risk management. Use a hardware wallet for added security, and never invest more than you can afford to lose. With a little bit of effort and research, you can unlock the potential of Balancer and start managing your crypto portfolio like a pro.

What If Balancer Didn't Exist?

Imagine a De Fi landscape without Balancer. The options for decentralized portfolio management would be significantly limited. Users would be forced to rely on more rigid and less customizable AMMs, hindering their ability to create tailored investment strategies. The efficiency of decentralized exchanges would also suffer, as liquidity would be more fragmented and trading costs would be higher. The innovation in the De Fi space would likely be stifled, as the lack of a flexible and programmable AMM would limit the development of new financial products and services. Balancer has played a crucial role in shaping the current De Fi landscape, and its absence would undoubtedly have a significant impact on the growth and evolution of decentralized finance. Balancer's contributions extend beyond just its core functionality. It has also fostered a vibrant community of developers, liquidity providers, and traders, all contributing to the growth and development of the ecosystem. Without Balancer, this community might not have formed, and the De Fi space would be a much less dynamic and innovative place.

Top 5 Benefits of Using Balancer Protocol

Let's break down the top 5 benefits of using Balancer Protocol. First, you get Automated Portfolio Management*: Balancer automatically rebalances your portfolio, saving you time and effort. Second,Customizable Asset Allocation*: Create pools with any asset allocation you desire, tailoring your investment strategy to your specific needs. Third,Liquidity Mining Rewards*: Earn BAL tokens by providing liquidity to Balancer pools, incentivizing participation and rewarding users. Fourth,Improved Capital Efficiency*: Balancer's flexible pool structure allows for more efficient use of capital compared to traditional AMMs. And fifth,Increased Trading Volume*: Balancer's low swap fees and efficient routing algorithms attract traders, leading to higher trading volume and increased fee earnings for liquidity providers.

Question and Answer about Balancer Protocol

Q: What is impermanent loss, and how can I mitigate it in Balancer?

A: Impermanent loss occurs when the price of the assets in your pool diverge from their initial values. To mitigate it, choose pools with less volatile assets, adjust your pool weights, or hedge your positions.

Q: How do I earn BAL tokens on Balancer?

A: You earn BAL tokens by providing liquidity to Balancer pools that are eligible for BAL rewards. The amount of BAL you earn depends on the pool's trading volume, your share of the liquidity, and the current BAL distribution schedule.

Q: Can I create a Balancer pool with any type of token?

A: Yes, you can create a Balancer pool with virtually any ERC-20 token. However, it's important to ensure that the tokens you choose have sufficient liquidity and are not susceptible to scams or rug pulls.

Q: What are the risks of using Balancer?

A: The risks of using Balancer include impermanent loss, smart contract vulnerabilities, and market volatility. It's essential to thoroughly research the pools you participate in, diversify your portfolio, and use a hardware wallet for added security.

Conclusion of Balancer Protocol Tutorial: Automated Portfolio Management & Liquidity Mining

Balancer Protocol represents a significant leap forward in decentralized finance, offering users unprecedented control over their portfolio management and liquidity mining strategies. From its flexible pool structures to its automated rebalancing capabilities, Balancer empowers individuals to participate in the De Fi ecosystem in a more efficient and customizable way. While risks such as impermanent loss should be carefully considered, the potential rewards of providing liquidity and earning BAL tokens make Balancer a compelling platform for both novice and experienced De Fi users. By understanding the core concepts outlined in this tutorial, you can confidently navigate the Balancer ecosystem and unlock the potential of automated portfolio management and passive income generation.

Post a Comment